Only 17% of Americans feel completely in control of their financial future

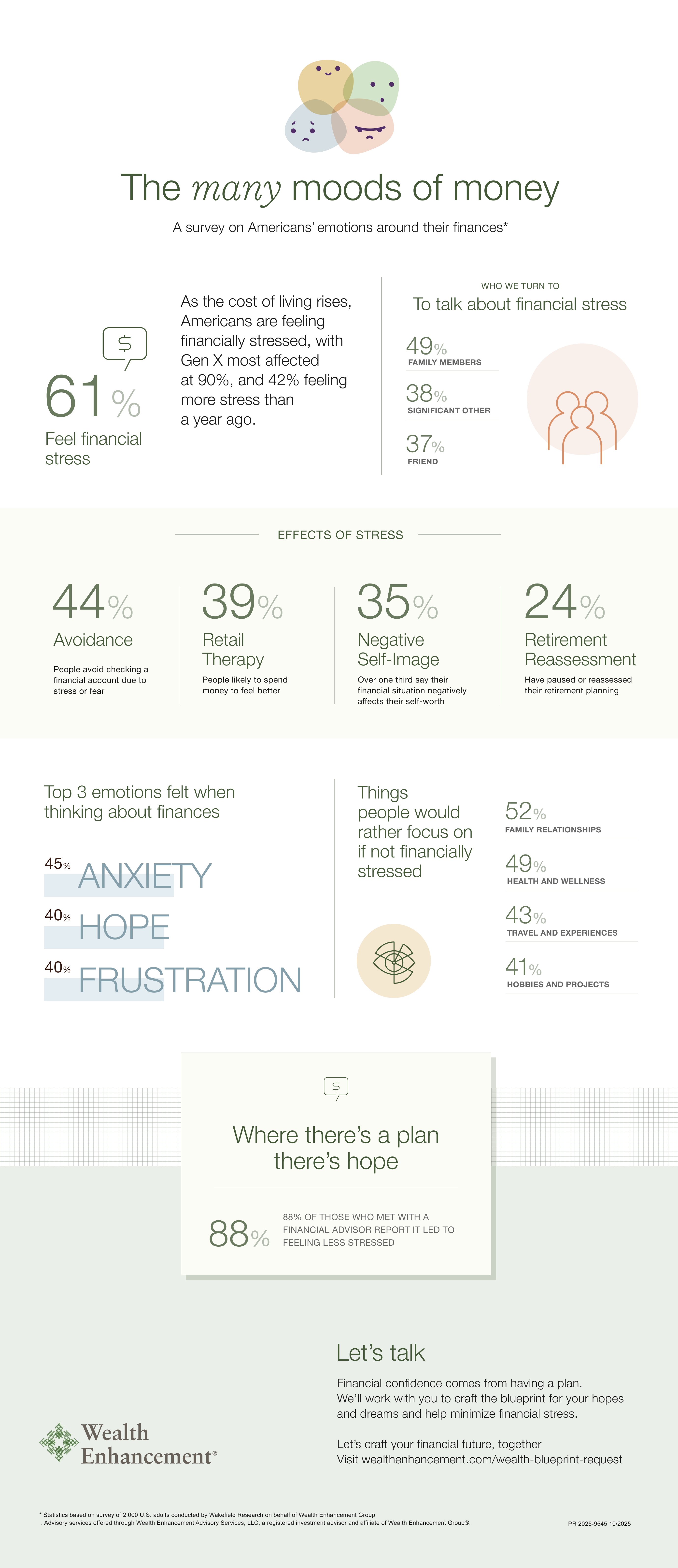

When we feel stressed or overwhelmed about something, we often avoid thinking about it. This is no different when it comes to finances. Over the past year, nearly half (44%) of U.S. adults avoided checking a financial account, such as a credit card balance or checking and investment accounts, due to stress or fear, according to a new Wealth Enhancement survey of 2,000 U.S. adults.*

Those who reported feeling very or extremely stressed about their finances (66%) adopted this avoidance most often, followed closely by Gen Z (63%). Of respondents who feel stressed, anxious, or sad, 39% said they are likely to spend money to feel better. Another 1 in 3 (34%) have paused or are reassessing their financial plans due to financial stress.

“Avoidance is a common stress response – when anxiety spikes, some people may choose to protect themselves by looking away,” says Wendell Clarke, a Behavioral Wealth Specialist with Wealth Enhancement. “That short-term relief can make problems feel bigger over time. Exploring the emotions and deeply held beliefs behind these behaviors can make a lasting impact.”

When it comes to personal finance, only 11% report feeling indifferent about their financial situation. In fact, many people report feeling strong emotions around their finances: nearly 6 in 10 (59%) experience difficult emotions, such as anxiety (45%) or frustration (40%) when they think about their finances, with Gen Z (65%) and Gen X (64%) especially prone to negative feelings.

For one third of U.S. adults (35%), their financial situation negatively affects their self-worth – especially among Gen X (42%). On the other hand, many people feel positively about their finances, with 40% expressing hope (50% of Millennials) and 22% feeling pride.

“Change does not often happen with the flip of a switch,” Clarke says. “It can take time and consistency. It starts with seeking to understand our beliefs and emotions and then requires taking incremental steps, often with the guidance of an objective financial advisor. That is how we trade avoidance for progress."

Clarke suggests first exploring the beliefs that drive negative emotions. Then, he says, make gradual changes that can lead to a true sense of confidence, such as talking through stress with loved ones, setting up automatic transfers, making intentional retirement plan contributions, and periodically checking account balances.

Meeting with a financial advisor can also help individuals feel more confident and empowered in their financial lives. In fact, 88% of those who met with a financial advisor in the past 12 months report feeling less stressed afterward. Clarke recommends researching different types of financial advisors to determine which is the best fit for your needs. For example, a Registered Investment Advisor (RIA) is a fiduciary legally required to act in their clients’ best interests. An RIA can also offer comprehensive planning and help craft a financial plan tailored to your specific situation.

Other key findings:

- Financial Strain: Though many factors contribute to financial stress, the top two current stressors for Americans are daily living expenses (55%) and housing costs (42%). 26% of respondents identified healthcare costs/ medical bills as a stressor; this concern is brought into even sharper focus, given that healthcare is a core issue at the center of the recent government shutdown.

- Set Aside: Nearly a quarter (24%) have paused or reassessed their retirement planning due to financial stress, a decision most prevalent among Millennials and Gen X (30%). Another 10% of Americans haven’t paused or reassessed their retirement planning – but they intend to.

- Clear Tradeoffs: If stress eased, 52% say they would be able to focus more on their family and relationships, and 49% would devote more time to health and wellness.

- Let’s Talk: Nearly half typically talk about financial stress with a family member (49%), significant other (38%), or friend (37%).

- Second Opinion: One third of U.S. adults (33%) have met with a financial advisor in the past 12 months, with Gen Z the least likely (18%) and Millennials most likely (47%). Of note, these conversations with a professional had a significant impact: 88% of respondents who met with a financial advisor report feeling less stressed afterward.

For more insights, visit Wealth Enhancement’s Mood & Money report .

* Methodology

The Wealth Enhancement “Mood & Money” survey was conducted by Wakefield Research among 2,000 nationally representative U.S. adults ages 18+, between September 9th and September 13th, 2025, using an email invitation and an online survey. The data has been weighted to ensure an accurate representation of nationally representative U.S. adults ages 18+.