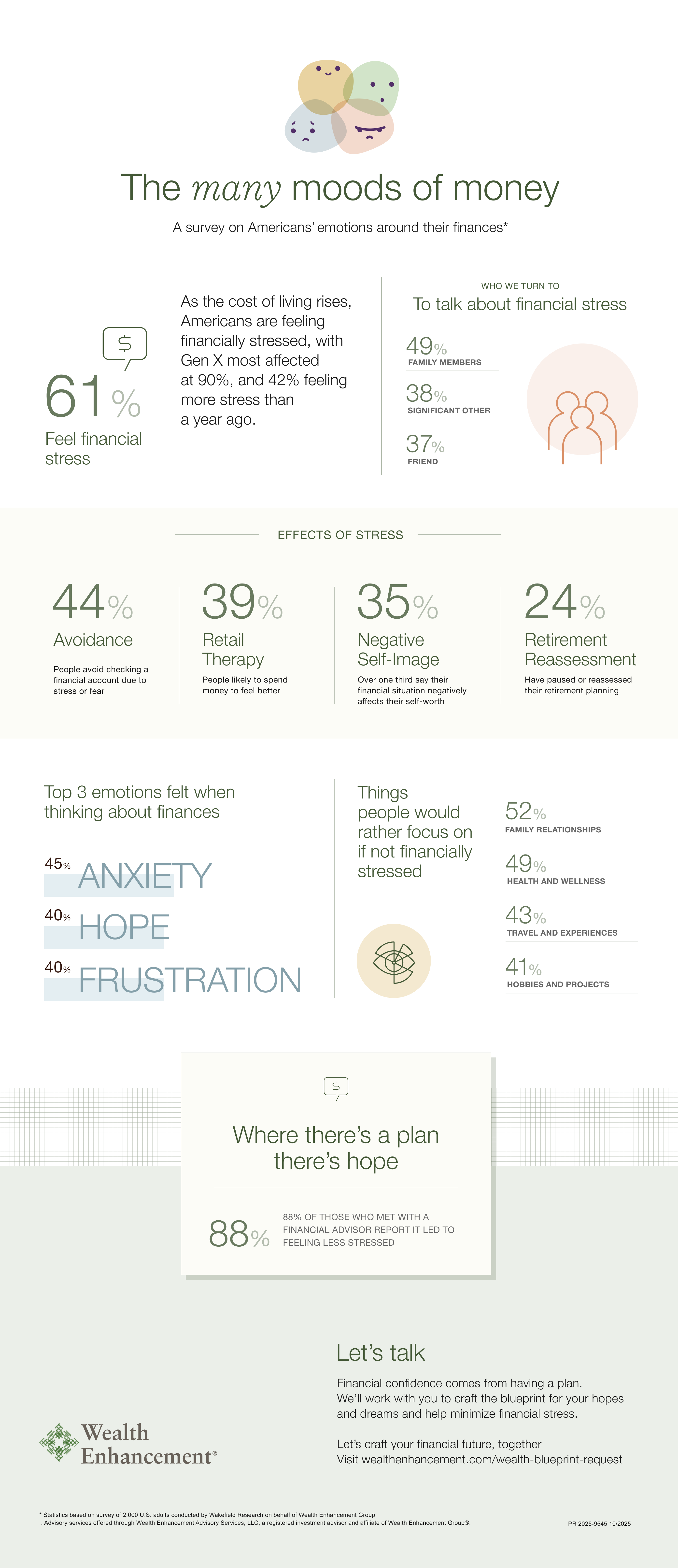

Nearly half of Americans avoid checking their financial accounts due to stress, according to a new report from Wealth Enhancement.

- Out of Sight, Out of Mind: In the past 12 months, 44% of Americans avoided checking a financial account due to stress or fear.

- On the Rise: 61% of Americans feel stressed about their finances, with 42% saying they are more stressed than they were a year ago.

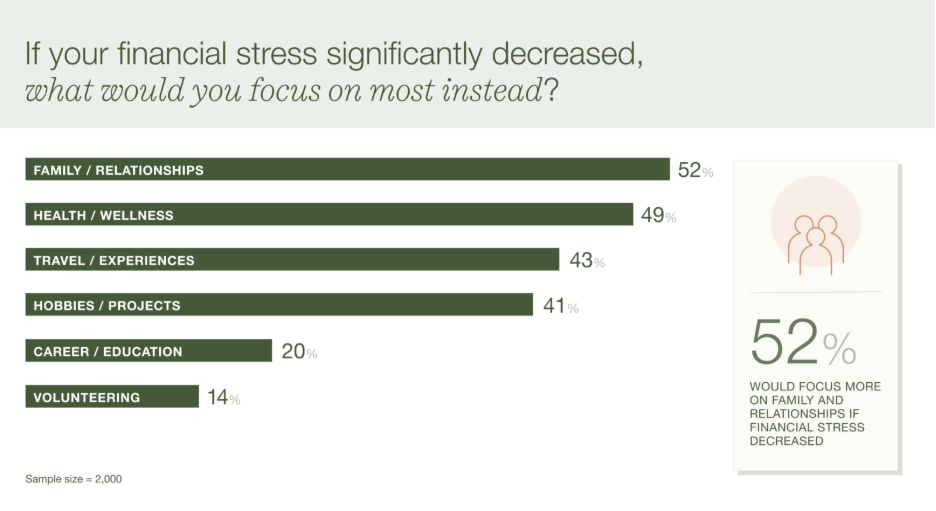

- Clear Tradeoffs: If stress eased, 52% say they’d be able to focus more on their family and relationships, and 49% would devote more time to health and wellness.

- Big Impact: 88% of those who met with a financial advisor report feeling less stressed afterward.

In the past 12 months, macroeconomic turmoil and rising costs have dominated the headlines and, in some cases, the headspace of American investors.

Over the past year, nearly half (44%) of U.S. adults avoided checking a financial account – whether a checking or credit card balance or an investment account – because of stress or fear, according to Wealth Enhancement research.*

Those who reported feeling very or extremely stressed about their finances (66%) adopted this avoidance most often, followed closely by Gen Z (63%). Of respondents who report feeling stressed, anxious, or sad, 39% said they are likely to spend money to feel better.

“Avoidance is a common stress response – when anxiety spikes, people may choose to protect themselves by looking away,” says Wendell Clarke, a Behavioral Wealth Specialist with Wealth Enhancement. “That short-term relief can make problems feel bigger over time. What makes a lasting impact is talking to an expert about the emotions and deeply held beliefs behind those behaviors.”

The Emotional Center

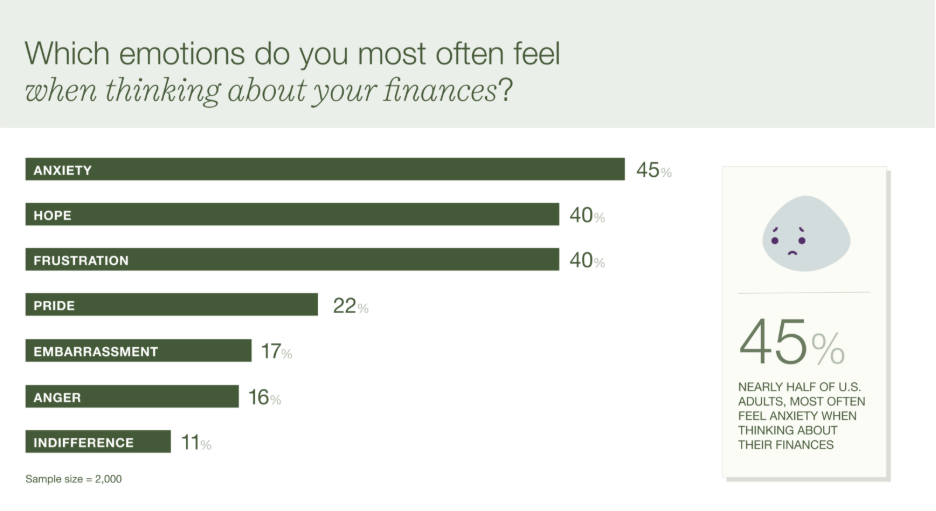

Personal finances cause a host of personal responses, but it turns out that almost everyone feels something. Only 11% say they feel indifferent about their financial situation.

Nearly 6 in 10 (59%) experience difficult emotions, such as anxiety (45%) or frustration (40%) when they think about their finances, with Gen Z (65%) and Gen X (64%) especially prone to tough feelings.

A third of U.S. adults (35%) claim their financial situation negatively affects their self-worth. This impact on sense of self is especially prevalent among Gen X (42%).

However, many people feel good about their finances, with 40% expressing hope (50% of Millennials) and 22% feeling a sense of pride.

Cause & Effect

Above all, however, tension is a common thread: 61% of Americans feel stressed about their finances. Though many factors contribute to financial stress, the top two current stressors for Americans are daily living expenses (55%) and housing costs (42%). 26% of respondents identified healthcare costs/medical bills as a stressor; this concern is brought into even sharper focus, given that healthcare is a core issue at the center of the recent government shutdown.

Under financial strain, some people are setting aside saving for the future. Nearly a quarter of adults (24%) have paused or reassessed their retirement planning due to financial stress, a decision most prevalent among Millennials and Gen X (30%). Another 10% of Americans haven’t paused or reassessed their retirement planning – but they intend to.

“Revisiting a financial plan in times of stress can be a positive exercise,” Clarke says. “When investing in the future, I encourage focusing on goals and values. This can offer a sense of control. And oftentimes, this naturally leads to the next single, doable step.”

More than half (52%) of respondents say that, if money weren’t a stressor, they would focus more on family and relationships. Those individuals, for instance, could prioritize time with their loved ones. This may lead to incremental financial decisions, such as gathering for a low-cost potluck at home instead of group dinners out or cutting back on discretionary spending to save up for a weekend away together.

Getting a Second Opinion

Mixed moods, rising stress levels, and avoidant behaviors can naturally blend into a pessimistic financial outlook: Only 17% of surveyed Americans say they feel completely in control of their financial future. “Complete control, however, is often an illusion,” Clarke reminds. “What we can control are our own actions and reactions.”

Talking through stress can be a powerful exercise, he adds. When dealing with financial strain, Americans are most likely to turn to their inner circle for comfort and advice. Nearly half typically talk about financial stress with a family member (49%), significant other (38%), or a friend (37%).

The vast majority (81%) think professional financial advice is important in reducing financial stress, including 17% who think it’s extremely important.

Still, only 33% have met with a financial advisor in the past 12 months. This financial action was least common among Gen Z (18%) and most common for Millennials (47%). These conversations had a significant impact: 88% of those who met with a financial advisor report feeling less stressed afterward.

“Change does not often happen with the flip of a switch,” Clarke says. “It can take time and consistency. It starts with seeking to understand our beliefs and emotions, and then requires taking incremental steps. That’s how we trade avoidance for progress.”

FAQs

What percentage of individuals report feeling stressed about their finances?

61% of survey respondents feel stressed about their finances.

How many people avoid checking their financial accounts?

Nearly half (44%) of respondents avoided checking their financial accounts in the past 12 months due to stress or fear.

How many people feel fully in control of their financial future?

Only 17% of respondents say they feel fully in control of their financial future.

What percentage of people have met with a financial advisor in the past 12 months?

33% of survey respondents have met with a financial advisor in the past 12 months.

If their financial stress eased, what would people focus more on?

52% of respondents say they would be able to focus more on their family and relationships, and 49% say they would devote more time to health and wellness.

Methodology

The Wealth Enhancement “Mood & Money” survey was conducted by Wakefield Research among 2,000 nationally representative U.S. adults ages 18+, between September 9th and September 13th, 2025, using an email invitation and an online survey. The data has been weighted to ensure an accurate representation of nationally representative U.S. adults ages 18+.

Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 2.2 percentage points from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.

About Wealth Enhancement

Wealth Enhancement is an independent wealth management firm with an endless passion for enriching the lives of our clients. We continually seek to perfect our craft of personalized financial planning with our team-based Roundtable™ and UniFi processes that go far beyond the standard approach. We proudly provide tailored financial plans and investment management services to serve the unique needs of our clients from our 150 offices - and growing - nationwide. Since 1997, Wealth Enhancement has tirelessly raised the standard of wealth management with specialized knowledge and more attentive service that helps every client craft their future. For more information, please visit www.wealthenhancement.com.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

Advisory services offered through Wealth Enhancement Advisory Services, LLC (WEAS), a registered investment advisor.

2025-9534