Key Takeaways

- Catch-up contributions let eligible savers contribute above the standard IRS limit for certain retirement accounts like 401(k)’s, 403(b)’s, and IRAs.

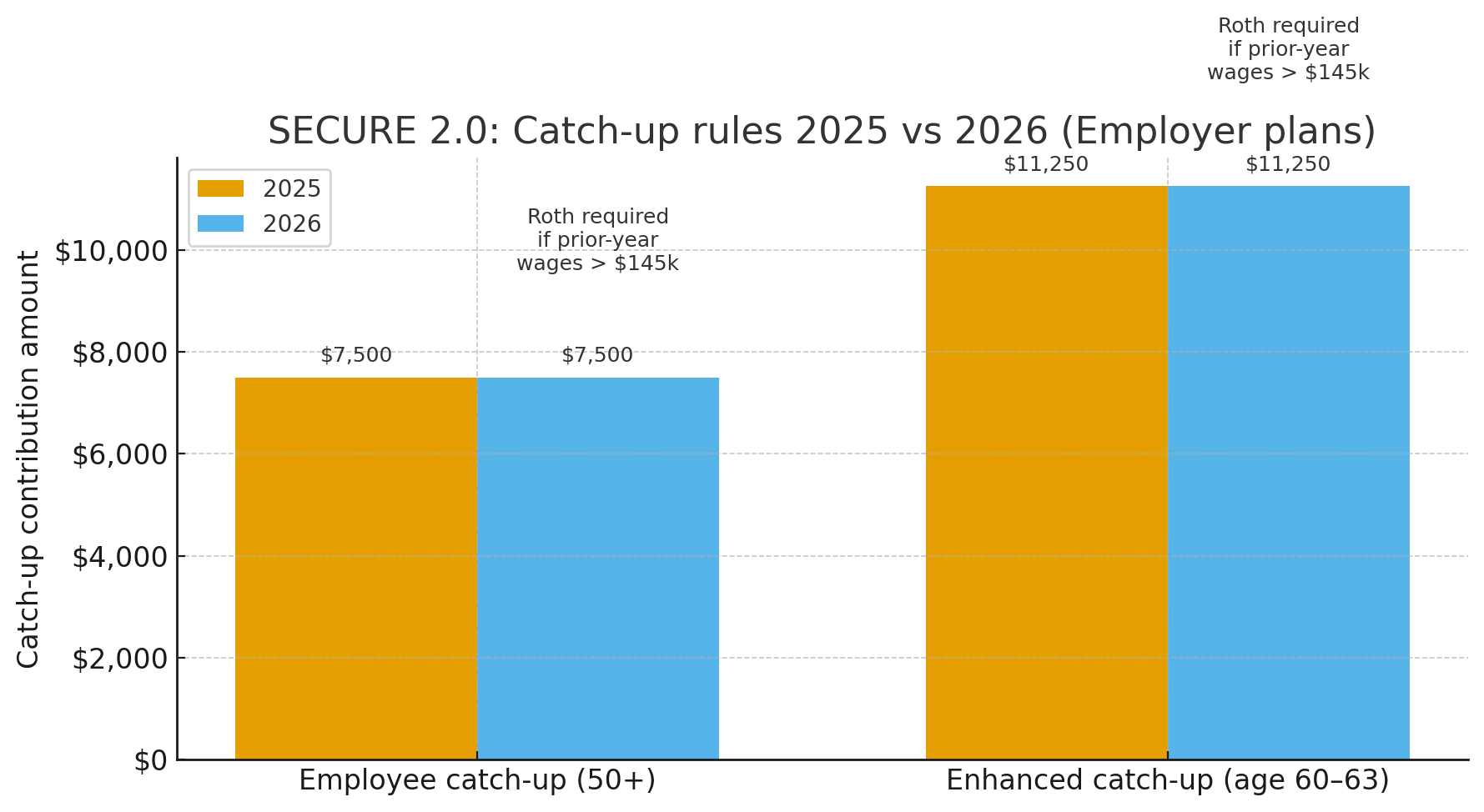

- In 2025, the standard 401(k) employee deferral limit was $23,500, with catch-up limits of $7,500 (age 50+) or $11,250 (ages 60–63).

- In 2026, the 401(k)-employee deferral limit rises to $24,500, and the standard catch-up rises to $8,000 (age 50+). The ages 60–63 catch-up remains $11,250.

As you get closer to your chosen retirement date, it’s not uncommon to feel a sense of unease. Sure, you’ve been saving and planning, but how can you be certain that you’ve done enough?

Adjusting your budget to reduce spending in retirement might be an option but could prove challenging at this stage of your life. Likewise, extending your retirement date could prolong your income stream but may be more complicated to manage as your wind down your working years and plan for what’s next. So, what else can you do?

Catch-up Contributions for 401(k) & IRA: 2026 Retirement Savings Limits

Fortunately, the IRS acknowledges that retirees-to-be face this conflicting dilemma, and offers some help. Starting at age 50, you are allowed to make “catch-up” contributions to your retirement accounts. These contributions can be the key to helping you put more money away as you navigate the home stretch into retirement.

But what are catch-up contributions, and how can you best leverage them in your retirement plan? Read on to find out.

What are Catch-Up Contributions?

Catch-up contributions allow savers to set aside additional funds beyond the maximum contribution normally allowed by the IRS. These additional contributions are subject to specific rules and requirements.

401(k) Catch-up Contribution Limits for 2025 and 2026

The IRS provides guidance detailing the maximum amount that you're allowed to contribute into qualified retirement accounts each year.

In 2025, savers are allowed to contribute up to $23,500 to a 401(k), 403(b), or most 457 accounts. This limit represents the total, in aggregate, of what you're allowed to contribute throughout the year. Importantly, $23,500 is the employee-directed maximum. Employer contributions (matches, profit-sharing contributions, etc.) do not count toward this total.

However, those 50 and older aren’t subject to the same limits. IRS provisions make saving for retirement more manageable in the later years with catch-up contributions. For 2025, individuals age 50 and older can make additional catch-up contributions of up to $7,500. Therefore, maxing out both your base 401(k) contribution and available catch-up contribution allows you to save $31,000 annually.

Finally, thanks to a change made in the SECURE 2.0 Act, starting in 2025, individuals ages 60, 61, 62, and 63 can make an increased catch-up contribution of $11,250 instead of $7,500. This brings their maximum contribution in 2025 to $34,750.

For 2026, 401(k) contribution limits increased again due to cost-of-living adjustments.

401(k), 403(b), and Governmental 457 Plan Catch-Up Contribution Limits

Year | Base Contribution Limit | Catch-Up Contribution (50+) | Catch-Up Contribution (60–63) | Max Total (50+) | Max Total (60–63) |

2025 | |||||

2026 |

Contact a Wealth Enhancement advisor about your retirement catch-up contributions today.

IRA Catch-up Contribution Limits for 2025 and 2026

Catch-up contributions also apply to IRAs. In 2026, you can contribute an extra $1,100 on top of the $7,500 annual limit on regular contributions. So, those 50 and older can contribute a total of $8,600 to a Traditional IRA in 2026.

To conclude, if you're 50 or older and have both a 401(k) and a Traditional IRA, you can contribute $9,100 more to your retirement accounts using catch-up contributions than someone younger than 50. And if you’re between ages 60 and 63, you can contribute $12,350 more. Talk about something that improves with age!

The charts below also include contributions for HSA accounts. HSA’s are separate from retirement accounts but are fantastic tools for long-term savings due to their tax benefits.

2025 IRA Plan and HSA Catch-Up Contribution Limits

Plan Type | Base Contribution Limit | Catch-Up Contribution (50+) | Catch-Up Contribution (60–63) | Max Total (50+) | Max Total (60-63) |

Traditional IRA, Roth IRA | $7,000 | $1,000 | $1,000 | $8,000 | $8,000 |

SIMPLE IRA | $16,500 | $3,500 | $5,250 | $20,000 | $21,750 |

HSA (Individual / Family) | $4,300 / $8,550 | $1,000* | $1,000* | $5,300 / $9,550 | $5,300 / $9,550 |

*Available to those only 55 and older

Source: Internal Revenue Service

2026 IRA Plan and HSA Catch-Up Contribution Limits

Plan Type | Base Contribution Limit | Catch-Up Contribution (50+) | Catch-Up Contribution (60–63) | Max Total (50+) | Max Total (60-63) |

$7,500 | $1,100 | $1,100 | $8,600 | $8,600 | |

$17,000 | $4,000 | $5,250 | $22,000 | $22,250 | |

HSA (Individual / Family) | $4,400 / $8,750 | $1,000* | $1,000* | $5,400 / $9,750 | $5,400 / $9,750 |

Sample Scenarios for 2026

A 49-year-old full-time employee of a small business has a SIMPLE IRA and a personal Roth IRA. Contributing the maximum to both accounts, they would add $24,500 to their retirement savings. That’s $7,500 to their Roth IRA and $17,000 to their SIMPLE IRA. Unfortunately, they’re under the age of 50 when catch-up contributions can be leveraged.

A 55-year-old full-time employee has an employer-sponsored 401(k) and a Roth IRA. If the employee chooses to fully fund each account and make the maximum in catch-up contributions, they would add $41,100 to their retirement accounts. They would add $8,600 to their Roth IRA and $32,500 to their 401(k).

A 62-year-old full-time employee has a 403(b) and a traditional IRA. Making the maximum base and catch-up contributions to both accounts would add $44,350 to them. That’s $8,600 to the IRA and $35,750 to the 403(b).

Changes to Catch-up Contributions Rules in 2026

SECURE 2.0 Act

The employer-sponsored retirement plan landscape is undergoing a significant shift regarding catch-up contributions. In 2025, the contribution limit for individuals ages 60 to 63 was introduced, and another major change is coming in 2026.

The Roth Requirement

In 2026, legislation included in SECURE Act 2.0 will require that individuals with wages exceeding $145,000 in the preceding year (indexed to inflation) must make any catch-up contributions to a Roth-type plan, such as a Roth 401(k).

This change not only impacts individual employees by forcing them to save their catch-up contributions with after-tax dollars and thus, reducing their tax deduction, it also mandates that employers offer a Roth plan if they intend to continue allowing catch-up contributions.

This initial provision was originally mandated to become active on January 1, 2024, but given the lack of time for payroll providers, administrators and recordkeepers, employers and employees to adequately prepare, the IRS announced a delay. The legislation took effect on January 1, 2026.

If you have questions about how this shifting retirement legislation could impact your retirement, contact your financial advisor.

Benefits of Catch-up Contributions

Maximizing catch-up contributions can come with income tax savings for those who save in tax-deferred retirement accounts. A $33,500 contribution to your 401(k) counts as a deduction to your income. At the 24% income tax bracket, that equates to a $7,800 federal tax savings. Potential savings are even higher for workers aged 60 through 63, who are likely nearing retirement and may even be in their last few working years. See the chart below for some additional examples.

Contribution Amount | 22% Tax Bracket Savings | 24% Tax Bracket Savings |

$32,500 (401k + Catch-up) | $7,150 | $7,800 |

$35,750 (401k + Catch-up at 60–63) | $7,865 | $8,580 |

Contribution Amount | 32% Tax Bracket Savings | 35% Tax Bracket Savings |

$32,500 (401k + Catch-up) | $10,400 | $11,375 |

$35,750 (401k + Catch-up at 60–63) | $11,440 | $12,513 |

These deductions can be particularly beneficial for employees later in their working careers, as these individuals often tend to be in their peak earnings years, with higher marginal tax rates.

Roth contributions and Roth catch-ups (which will become mandatory for some in 2026) are another option. While they don’t provide the same tax deduction that pre-tax contributions do, they allow tax-free withdrawals and less onerous distribution requirements in your retirement years.

Thinking about how the tax treatment of your contributions fits into your short-, mid-, and long-term plan is an important step. Everyone’s situation is different, but taking advantage of the increased contribution limits is an easy way to ensure you’re maximizing your retirement savings potential. This, along with carefully constructed financial plan, can help make sure you’re still on the path to the retirement of your dreams.

Catch-Up Contribution FAQs

What is the 401(k) catch-up contribution limit for 2025?

The 401(k) catch-up contribution limit in 2025 is $7,500 for individuals age 50 and older, and $11,250 for individuals age 60 through 63. The increased limit for workers in their 60s is a new feature in 2025.

What is the 401(k) catch-up contribution limit for 2026?

The 401(k) catch-up contribution limit in 2026 is $8,000 for individuals age 50 and older, and $11,250 for individuals age 60 through 63. The increased limit for workers in their 60s is a new feature in 2025.

Can I contribute to both a 401(k) and IRA catch-up?

Yes, you can contribute catch-up contributions to both your 401(k) and your IRA. The two accounts are unrelated, meaning you can max out both each year, regardless of how much you’ve contributed to the other.

What happens if I over-contribute to my 401(k)?

If you over-contribute to your 401(k), the excess amount will be a part of your taxable income in the year you contribute, as well as in the year its distributed. You can avoid this double-taxation by taking a corrective distribution from your 401(k), which should include your excess contribution and any income it has earned.

Does the max 401(k) contribution include an employer match?

There are two separate 401(k) contribution limits: one for employee contributions and one for employees and employers combined. The combined contribution limit in 2025 is 100% of your compensation or $70,000, whichever is lower. Catch-up contributions can be made on top of the employee-employer limit.

Are 401(k) contributions tax-deductible?

Whether your 401(k) contributions are tax-deductible depends on the type of account you have. If you have a traditional 401(k), your contributions are tax-deductible. If you have a Roth 401(k), you can’t deduct your contributions, but you’ll be able to withdraw from the account tax-free during retirement.

What happens if I don’t use my catch-up contributions?

If you don’t use your catch-up contributions in a given year, your retirement contributions will be lower than they could have been. While there’s technically no penalty for contributing less, you are passing up the opportunity of more tax-advantaged savings. However, because everyone’s financial situation is different, each person can contribute as much or as little as they’re financially able to.

Do Roth catch-up contributions grow tax-free?

Yes, your Roth catch-up contributions grow tax-free in your account. Roth contributions are taxed upfront. There’s no tax advantage for your initial contribution, but then you’ll get tax-free investment growth and withdrawals later on.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

#2026-11229