AI has been called a disruptor, a game-changer, and the next frontier in investment management. Every day, analysts use AI models to manage risk, inform credit decisions, and automatically detect fraud. One of the most popular uses of AI is in portfolio modeling, where algorithms use historical data to make predictions about the future performance of various asset classes.

AI is becoming increasingly important to financial firms for managing risk and improving operations and compliance. But what are AI’s potential benefits for individual investors?

- AI's transformation of every industry will create innovative new companies and exciting opportunities for investors.

- Financial advisors use AI tools to generate insights and customize client portfolios more effectively.

- AI has great potential to help alpha-seeking investors manage risk and model long-term performance.

AI’s ability to analyze large, unstructured datasets is increasing our predictive power in several ways. While we can't predict the future, we can use AI to improve our predictive capabilities and decision-making. Wealth Enhancement Group has been exploring different types of AI designed to amplify human intelligence rather than replace it. Equipping our experienced financial advisors with more powerful predictive tools represents a unique opportunity, with an eye on improving returns, managing risk, and creating improved client experiences.

Enter the Swarm

Swarm AI is a class of AI that uses the collective behavior of swarm animals (such as ants, birds, and bees) as inspiration for its algorithms. These animals solve problems as a group, using their intelligence to implement agile solutions actively. Swarm AI, a collaborative platform developed by Unanimous AI, uses an algorithm trained by data informed by group behavioral dynamics. This technology allows individuals to answer questions collectively, with the AI reacting and facilitating the decision-making process to encourage an outcome. Then, another AI model assesses the group's behavior and assigns a "conviction score" to gauge their confidence in the decision.

Wealth Enhancement Group is always looking for ways to empower our advisors to provide more personalized, responsive service. To that end, we tested Swarm AI with a small team of our expert advisors. We asked them a series of questions about 2023's outlook, using the Swarm AI platform to collect insights. This article highlights our results.

2023 Economic Outlook

The first topic our advisors addressed was the general economic outlook for 2023. Through the following questions, we used AI to gauge our advisors' sentiments effectively and gleaned some insightful results. It is important to note that the decisions and answers presented in this article should not be relied on as financial advice. This article aims to demonstrate one way AI can help amplify human intelligence in financial advising and give our advisors the chance to express their opinions.

We asked our advisors, what is the biggest risk the stock market will face in the next six months?

- Recession

- Weak corporate profits

- Inflation

- Geopolitical turmoil

- Employment

- Federal Reserve intervention

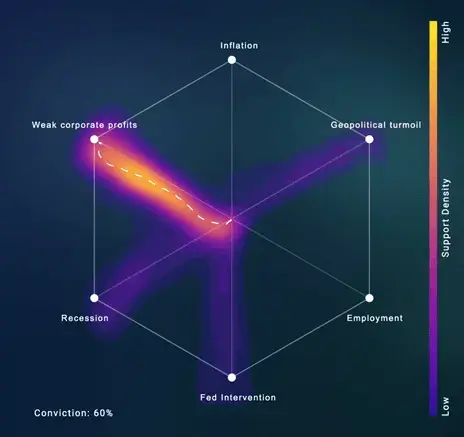

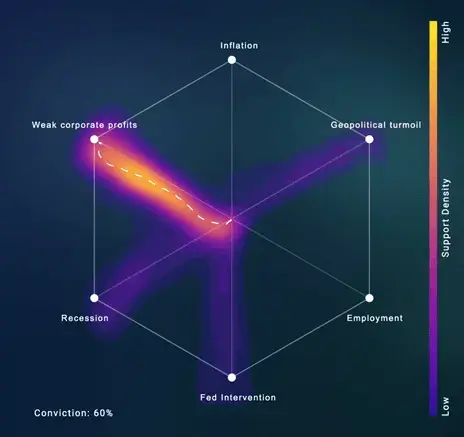

To kick off our session, we asked members of our Roundtable™ team of advisors the biggest risk stocks would face in the first two quarters of 2023. Using Swarm AI software to track the group's collective sentiment, they answered with “Weak corporate profits.” The heat map below visualizes the amount of support each answer received.

Figure 1: Our panel speaks about weak corporate profits are the biggest challenge to stocks

Interestingly, our advisors chose weak corporate profits as more impactful than inflation or employment. They ultimately suggested that weak corporate profits may lead to a decrease in investor confidence and a price decline. In a market environment like this, our advisors prioritize keeping a close eye on the companies' earnings reports in their client's portfolios.

What are the odds the U.S. will enter a recession in the next 12 months?

Given the unrelenting impacts of inflation, continued Federal Reserve rate hikes, and global geopolitical turmoil, our advisors collectively decided there is a 75% chance that the U.S. will enter a recession in 2023. Our team landed on this pessimistic outlook with a reasonable level of confidence, which indicates that investors should account for this possibility as we progress through the year.

If we do enter a recession in the next 12 months, how long is the recession most likely to last?

When we asked advisors how long a 2023 recession could last, they responded with a high conviction that the recession would last only up to 6 months. The graphical data of our advisors' deliberations show that the most popular responses were between 2 to 3 quarters.

Using GDP decline as our benchmark, we asked advisors, how severe will this potential recession would be?

Our advisors decided a shallow (1-2%) recession is most likely, as shown in the heat map below.

Figure 2: Our panel speaks that the recession will likely be shallow.

Our advisors predicted a 75% chance that 2023 will yield a shallow (1-2%) recession lasting about two financial quarters.

How likely is a "stagflation" scenario for the U.S. economy in the next six months?

The dreaded "stagflation" scenario combines slow economic growth, high unemployment, and inflation. Our advisors said stagflation is unlikely during the first two quarters of 2023. While these conditions regularly occur at different times throughout economic cycles, it’s less common to see an alignment of all three, especially during a tight employment market.

Which major equity market will perform best in the next 12 months?

Our advisors initially needed help to reach a consensus when we asked this question. They were confident in their positions, to the point that they could not come to a clear answer as a group, highlighting the truth to the statement markets are unpredictable. When we asked the question again, they suggested Emerging Markets as the strongest performer but with only 30% conviction.

Figure 3: Our panel speaks, selecting Emerging Markets as the strongest performing market.

Perhaps the uncertainty of our advisors' consensus reflects a fundamental belief in portfolio diversification and not overweighting any one market or region.

Fed Report Card

The Fed plays a crucial role in our economic system, and its policies significantly impact individual investor portfolios. In this series of questions, we asked our advisors to "grade" the Fed, from A through F, on its performance in driving the U.S. economy.

We asked our advisors…how would you grade the Fed’s efforts in managing the following issues?

- Fed’s grade on: Employment

Our advisors' grade? A C+, with an 84% conviction rate, shows high confidence. While the unemployment rate may currently be relatively low, this grade may change along with the rate hikes we've recently experienced if the increases lead to a softer labor market in 2023.

- Fed's grade on: Stabilizing inflation

Our advisors' grade? A D, with a 71% conviction rate. The Fed's rate hikes seem to be working to lower the blistering rate of inflation.

- Fed’s grade on: Avoiding a Recession

Our advisors' grade? Another D, with an 89% conviction rate, is our experiment's highest conviction rate. Advisors needed to be more impressed with the Fed's actions to avoid a recession. The need to rein in inflation has forced the Fed to raise rates very quickly, negatively impacting investor portfolios and boosting the likelihood of a recession.

Wealth Enhancement Group: How It All Fits Together

We asked our advisors… what investors value most in their Financial Advisor?

Although most of the answers below received some level of support:

- Inspire confidence

- Clear communication & explanations

- Professionalism

- Personal attention

- Detail-oriented

- Since their time is valued

Our team of advisors landed on clear communication & explanations as their best answer. A financial advisor is responsible for analyzing and interpreting various financial information. Clear communication about their findings makes it easier for an advisor to help their client's financial plans stay on track.

Finally, we asked our advisors… which investor action should be the HIGHEST priority now?

- Trim expenses

- Pay down debt

- Boost emergency fund

- Avoid impulsive decisions

- Explore alternative investments

- Consider available tax efficiencies

In the uncertain macroeconomic environment, our advisors considered what investors should prioritize in 2023. While exploring alternative investments and considering tax efficiencies were popular among some of our advisors, the winning answer was to avoid impulsive decisions. Our advisors know it can be easy to make emotional and financial decisions in difficult times. It's of the utmost importance to avoid this type of decision-making. Fortunately, our experienced advisors are here to help with that!

About this research

Our goal in this exercise was to convene Wealth Enhancement Group advisors with Swarm AI technology to gather insights and unlock the group's collective intelligence. We evaluate this technology and others for its capabilities as predictive decisions and forecasting tools.

Swarm AI® technology, developed by Unanimous AI and used by our advisor teams for this article, employs real-time human input and AI algorithms modeled after swarms in nature. Nature shows us that groups can produce insights that greatly exceed the abilities of any individual member. Research indicates that Swarm AI technology enables human groups to amplify their intelligence, an intriguing proposition for financial services.

Swarms have generated insights for the Washington Post, TechCrunch, TIME, Forbes and a host of Fortune 500 companies. More published research using Swarm® is available on the Unanimous AI website.

For more information on leveraging the power of Wealth Enhancement Group's UniFi™ process and applying our collective intelligence to your financial plan, set up a free, no-obligation meeting with an advisor today.