For the period June 1 – June 30, 2025.

Executive Summary

The headline of the first half of 2025 is that we endured a tariff shock, war between Israel and Iran, civil unrest in Los Angeles, and concerns of a looming recession—and still finished Q2 with the S&P 500 at an all-time high. While U.S. equity markets have recovered losses from the first quarter, economic uncertainty remains elevated, as the potential impact of tariffs could still hinder growth in the months ahead.

What Piqued Our Interest

As the market climbs to new highs, valuations have elevated, with the S&P 500 Forward Price-to-Earnings (P/E) ratio ending the quarter at 22x—well above the 30-year average of 17x (times earnings). At 1.5 standard deviations above average, this suggests that investors are pricing in a very optimistic outlook despite the potential negative impacts from tariffs to economic growth. While an elevated P/E ratio can be a sign of confidence, it also implies that markets may be more vulnerable to disappointment if earnings or macroeconomic data fall short of expectations.

Turning toward the denominator within the P/E formula, earnings growth in 2025 has been propelled by margin expansion. According to JP Morgan, profit margins contributed to 4.7% of the total 8.7% in total earnings growth so far this year, which is more than twice the average of 2.2% observed between 2001 and 2024. This is notable because it shows that companies have been able to maintain profitability despite rising input costs and policy uncertainty. However, margin expansion is not limitless; future earnings growth may require stronger top-line revenue gains, which could be harder to achieve in a slower-growth environment.

As market multiples have reclaimed recent highs, so too has market concentration. The top 10 stocks in the S&P 500 now comprise over 38% of the index, up from around 27% in 2001 and 32% in 2022. This level of concentration means that a small number of companies are driving a disproportionate share of index performance. While this can benefit investors when those top “Mega Cap” companies are performing well, it also increases portfolio risk if those names falter. As always, diversification, both across sectors and geographies, remains a key risk management tool.

Shifting focus to macroeconomic data, labor market data from the Job Openings and Labor Turnover Survey (JOLTS) indicates a cooling trend. Both job openings and total quits are now below pre-pandemic levels, suggesting a slowdown in labor market momentum. Additionally, the three-month average of nonfarm payrolls stands at 135,000, a level that reflects moderation from the robust job growth seen in recent years. For investors, a softening labor market could signal slower consumer spending ahead, which may impact corporate revenues. It also increases the likelihood of Federal Reserve intervention through rate cuts, which could support asset prices but also reflects underlying economic fragility.

Market Recap

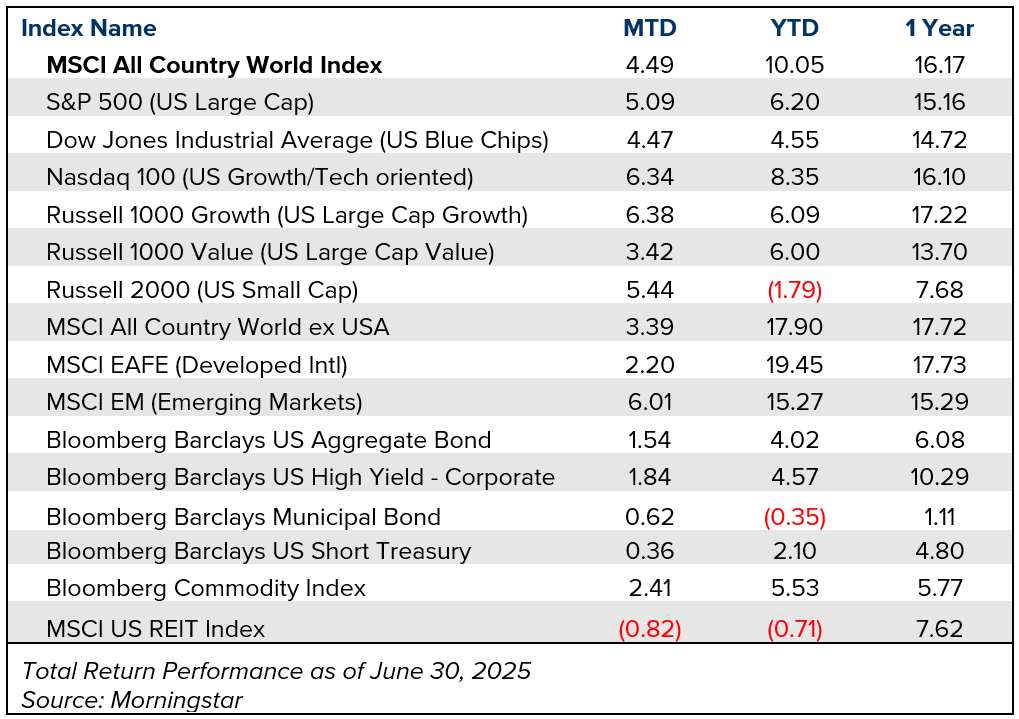

Markets posted strong gains in June, with the S&P 500 rising 5.09% and reaching new all-time highs. Small Cap stocks also participated in the rally, with the Russell 2000 Index gaining 5.44% for the month. This rebound in Small Caps is notable given their underperformance earlier in the year and may reflect renewed investor optimism around domestic economic resilience and potential rate cuts. International equities kept pace with U.S. markets in Q2 but continue to outperform year to date, particularly due to strong Q1 performance and fueled by a softer U.S. dollar, as the U.S. exceptionalism trade has faded.

Gold has continued to perform well in 2025, up over 27% year to date, benefiting from the weaker U.S. dollar and persistent geopolitical uncertainty. As referenced, the U.S. dollar experienced its largest half-year decline since 1973, falling just over 11%. This has provided a tailwind for some commodities, including precious metals, with gold recently serving as a hedge against both inflation and volatility.

Bond markets held their ground, with the Bloomberg Barclays U.S. Aggregate Bond Index up 1.54% in June and 4.02% year to date. The yield on the 10-year Treasury ended June at 4.23%, down from 4.57% at the start of the year. This decline in yields has supported fixed income returns and reflects market expectations for potential monetary easing in the second half of the year.

Wealth Enhancement Perspective

Just three months ago, amid peak tariff uncertainty, few would have predicted that markets would be setting new all-time highs by midyear. This remarkable turnaround highlights the importance of maintaining a long-term perspective and avoiding reactionary decisions based on daily headlines. Reacting to short-term noise is more akin to speculation than investing.

Despite the recent rally, questions linger, and uncertainty remains. The outcome of pending tax legislation could have significant implications for an already-strained fiscal landscape. At the same time, the full economic impact of newly imposed tariffs has yet to be realized and may weigh on growth in the months ahead.

Looking ahead, we anticipate at least one interest rate cut this year—possibly two—though the Federal Reserve is likely to proceed cautiously. Any signs of reaccelerating inflation could temper the pace of easing, reinforcing the need for a balanced and flexible investment approach.

In this environment, it’s essential not to let emotions drive investment decisions. Policy shifts, geopolitical tensions, and mixed economic signals are likely to continue fueling volatility. Staying disciplined, diversified, and focused on long-term goals remains the most effective strategy for navigating an uncertain landscape.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

There is no guarantee that asset allocation or diversification will enhance overall returns, outperform a non-diversified portfolio, nor ensure a profit or protect against a loss. Investing involves risk, including possible loss of principal.

2025-8393