Life happens. The reality is you may not always be there for your loved ones, but you can always take care of them. One of the best ways to do that financially is with life insurance.

That’s the thought behind the nonprofit organization Life Happens’ “Insure Your Love Month” campaign every February. The concept for their 2020 campaign is “A Promise Kept,” which asserts that life’s major milestones generally come with a promise: to love, cherish, guard and protect. And if something happens to you, are you able to keep that promise?

How Much Life Insurance Do You Need?

Undoubtedly, life insurance is an uncomfortable topic, but it’s an important conversation to have for the financial well-being of your loved ones. As the Life Happens campaign says, “the basic motivation behind life insurance is love”–although life insurance can’t change the pain of losing a loved one, it can be life-changing for those who survive.

Think about it–one of the most stressful events you can experience is the loss of a loved one, and life insurance can ease the financial stress associated with that loss when they need it most.

So how much life insurance do you need? Unfortunately, there’s no easy answer. The amount of coverage you “should” purchase depends on what you want the life insurance to accomplish. The best way to figure that out is with an analysis of your family and personal financial situation, along with your financial goals and objectives.

Depending on your family’s financial needs, your loved ones can use life insurance funds for a variety of circumstances such as:

- Replacing a portion or all of your income

- Covering the mortgage to keep your family in their home

- Paying for final expenses, including medical costs

- Paying off debt

- Establishing a college education fund

- Covering financial emergencies

Often, insurance offered through your employer is only equal to one years’ salary, give or take. You may have the option to purchase additional coverage through your employer, but keep in mind that often isn’t portable if you transition jobs to a new employer. Whether through your employer or individually, you may need to purchase additional coverage depending on your family’s financial goals and what you’d like your life insurance to cover.

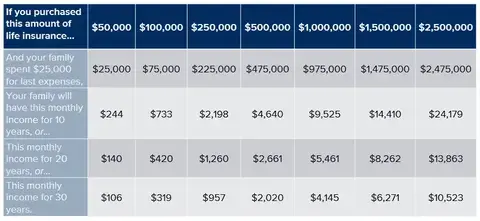

The chart below gives a good frame of reference for what different amounts of life insurance could mean for your family over the years.

For illustrative purposes only. Assumes 3% rate of return per annum on the Life Insurance Proceeds. All income amounts are shown pre-tax.

When Should You Purchase Life Insurance?

Insurers will primarily look at your age and health when determining your eligibility and monthly premium pricing for your life insurance policy. The younger and heathier you are, the longer you are likely to pay premiums, which means the insurer is taking on less risk to insure you. As such, there’s plenty of conventional wisdom floating around that suggests investing in life insurance as soon as possible to lock in lower premiums, even as young as when you’re in your 20s and 30s.

That said, affordable and high-quality coverage is available at any age. But no matter your age, if you have children or other financial dependents, there’s a good chance your family could benefit from the protection of a life insurance policy. Protecting your loved ones from the unexpected is an important part of a strong financial plan. The important thing is to choose the right life insurance for your budget and your needs.

Over the years, your needs, your family situation and your life goals will evolve. When that happens, it’s also time for you to re-evaluate the right type of insurance for you to ensure you are covered properly. Your financial advisor is there to provide some guidance in this process, based on your reality and your goals.

When is the Best Time to Increase Life Insurance?

Life insurance isn’t a “set it and forget it” decision. As your life changes, your coverage should too. The best time to increase life insurance is usually when your financial responsibilities grow or your plans shift.

These life events are often good times to revisit your coverage:

- Getting married or divorced

- Having children or adopting

- Purchasing a home or taking on a larger mortgage

- Starting or growing a business

- A significant increase in income

- Taking on caregiving responsibilities for aging parents

- Major changes to your long-term financial goals

Even positive milestones can introduce new financial risk. Reviewing your coverage during these transitions helps ensure your life insurance still reflects the reality of your life — not the version of it from years ago.

Who Can I Talk to About Life Insurance?

Because life insurance decisions are closely connected to the rest of your finances, it can be helpful to work with a financial advisor instead of trying to figure it out alone.

A Wealth Management Advisor can help you determine how much coverage makes sense, choose the right type of policy, and make sure your life insurance fits into your overall financial strategy. As your life changes, they can also help you revisit and adjust your coverage to stay aligned with your needs.

Life Insurance FAQs

How do I calculate how much life insurance I need?

There’s no one-size-fits-all formula, but a good starting point is to consider what your loved ones would need financially if you were no longer there. This typically includes things like income replacement for a set number of years, outstanding debts such as a mortgage or credit cards, future expenses like college tuition, final expenses and medical costs, and ongoing living expenses and emergency reserves.

For business owners, this may also include buy-sell obligations or coverage to help stabilize the business. A financial advisor can guide you through a comprehensive calculation and help ensure your life insurance coverage truly reflects your needs and protects what matters most.

What is the 10x rule for life insurance?

The 10x rule suggests carrying life insurance equal to ten times your annual income. While easy to calculate (80k income becomes $800k coverage), it’s not always sufficient — or appropriate — for every situation. The rule doesn’t account for existing savings or investments, a working spouse or partner, inflation over time, or major upcoming expenses (like education or caregiving).

Can you have more than one life insurance policy?

Yes. Many people carry multiple life insurance policies to meet different needs. For example, you might have one policy through your employer and another individual policy you own personally. Having multiple policies can provide flexibility, especially if employer-sponsored coverage isn’t portable or sufficient on its own.

What are common mistakes people make when choosing coverage?

Some of the most common mistakes include:

- Buying too little coverage

- Waiting too long to purchase

- Relying solely on employer-provided life insurance

- Not comparing options

- Underestimating future expenses or inflation

- Choosing coverage based only on price, not fit

- Failing to update policies after major life changes

- Assuming “more coverage” always equals better coverage

Avoiding these pitfalls often comes down to revisiting your plan regularly and getting objective guidance from a trusted advisor.

How much life insurance do I need if my kids are almost grown?

As children become financially independent, life insurance needs often decrease — but they rarely disappear entirely. You’ll likely still want coverage to support a surviving spouse’s retirement, pay off remaining debt, cover final expenses, or leave a legacy or charitable gift. This is a common stage where reassessing, rather than canceling, coverage can help you right-size your plan.

The opinions voiced in this article are for general information only and are not intended to provide specific advice or recommendations for any individual.

This article contains only general descriptions and is not a solicitation to sell any insurance product or security, nor is it intended as any financial or tax advice. For information about specific insurance needs or situations, please contact your insurance agent. State insurance laws and insurance underwriting rules may affect available coverage and costs. Guarantees are based on the claims paying ability of the issuing company.

#2026-10854