"The map is not the territory."

So said Polish American scholar Alfred Korzybski as a warning to those who conflate representations of reality with reality itself. Just as a map represents a simplified model of the underlying terrain, the stock market is just one indicator of U.S. economic performance. Despite the prominence of the S&P 500, it doesn't necessarily reflect the economy's overall performance, especially around recessions.

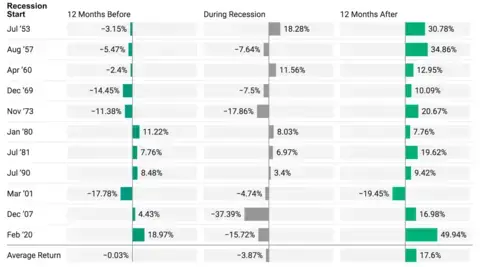

The National Bureau of Economic Research defines recessions' start and end dates by analyzing various indicators with no fixed rules or weights. A quick look at the performance of the S&P 500 during recessions since 1950 shows some intriguing patterns. Let's take a look at the numbers.

How Stocks Perform Before, During & After Recessions

The S&P 500, a widely used stock market index, provides numerous economic cycles to observe throughout its history. Understanding how this index performs before, during, and after recessions can provide valuable insights into market behavior and help investors make informed decisions. This historical data can't predict the future, but it helps to analyze the patterns and trends associated with the S&P 500 during economic downturns.

Data source: Robert Schiller Online Data

Before

The S&P 500 typically experiences a period of growth and optimism. As economic indicators signal a robust economy, investors display confidence, increasing stock prices. During this phase, the index often achieves record highs. As signs of an impending recession emerge, such as declining corporate profits or weakening consumer sentiment, markets often experience increased volatility. Investors become more cautious, resulting in a gradual slowdown and potential corrections in the index.

During

The S&P 500 faces significant challenges: falling corporate earnings, reduced consumer spending, and increased uncertainty mark economic downturns. As a result, stock prices tend to decline, and the index enters bear market territory. The recession's severity plays a crucial role in determining the magnitude of the market decline. Major recessions, like the Great Recession of 2008, can lead to substantial drops in the S&P 500. However, not all recessions result in a prolonged and severe decline in the index. Some economic downturns may be milder, resulting in shorter-lived market downturns.

After

Following a recession, the S&P 500 has likely already benefited from an expected recovery phase. The market and the index can be forward-looking, so the stock market sometimes recovers before seeing an economic rebound. By the time the economic data recovers, the stock market will have likely already entered a bull market. Historically, the market has responded positively to the end of recessions, marking the beginning of bull markets. During this phase, the S&P 500 has shown resilience and the ability to generate substantial gains. The duration and speed of the recovery can vary based on several factors, including the recession's severity and the economy's overall strength.

The stock market’s recovery after a recession may happen quickly or take longer to play out. However, the S&P 500 has displayed an upward trend over the long term and often surpassed pre-recession levels.

What Does the Data Tell Us?

- Recessions in the U.S. accompany reductions in the value of the S&P 500. However, we found that 5 out of the 11 recessions studied actually resulted in an increase in stock values during the recession itself. Additionally, the year before a recession began averaged a loss in value, despite this period leading up to the relative "peak" before the slump kicked in.

- With one exception, the 12 months after recessions end are marked with considerable value growth—a 17.6% gain, on average. This growth underscores the importance of holding stocks through a recession. Reacting impulsively to the unrealized losses experienced before and during a recession may result in missing out on the subsequent rebound.

- The stock market is a component of the larger economy. They aren't the same. The value of the S&P 500 isn't necessarily correlated with the health of the economy at large and can even act contrarily.

Our key takeaway? Understand that each recession unfolds differently—and it’s always a good idea to consult a financial professional before making any changes to your portfolio. As an investor, working with your advisor to understand historical trends and research, diversify portfolios, and employ long-term investment strategies is crucial.

By staying informed about economic indicators and market trends and seeking professional advice, investors can navigate the complexities of the stock market and make informed decisions aligned with their financial goals.