For the period July 1 – July 31, 2025.

Executive Summary

Markets closed July on a high note, with the S&P 500 Index brushing against record levels thanks to strong corporate earnings and encouraging developments on the trade front. Yet, beneath the surface, signs of economic moderation—particularly in the labor market—have begun to emerge.

What Piqued Our Interest

Trade Policy: Trade policy remained a central theme throughout July. The month began with the passage of a long-awaited budget bill, which provided clarity on corporate taxes and government spending priorities. However, attention quickly shifted back to tariffs. The U.S. made significant progress in renegotiating trade terms with key partners, including China, Japan, Europe, and the UK. As part of these new trade regimes, the reciprocal tariff rate was raised to 15%—up from the 10% proposed in April—while product-specific tariffs, particularly on automobiles, were adjusted downward to match the new baseline. If realized, this would represent a significant increase from pre-2025 levels by 2027, with broad implications for supply chains, inflation, and corporate margins.

Inflation Trends: Inflation data offered a mixed picture. Core CPI rose just 0.2% in June, undershooting forecasts for the fifth consecutive month. Yet the Fed’s preferred inflation gauge, Core PCE, was up 0.3% month-over-month and 2.8% year-over-year—an uptick from the same period last year. This suggests that while inflation is no longer accelerating, progress toward the Fed’s 2% target remains slow.

GDP Growth: Meanwhile, the broader economy showed signs of resilience. Second-quarter GDP grew at an annualized rate of 3%, which beat expectations. This was driven by steady consumer spending and a sharp drop in imports. Job openings also declined modestly in June, indicating a cooling—but not collapsing—labor market.

Labor Market Deceleration: The most striking data point came on August 1, when the July jobs report revealed a significant slowdown in hiring. Payrolls rose by just 73,000—well below expectations—and prior months were revised down by a combined 260,000. This marked the sharpest downward revision to job growth since the pandemic era, raising concerns about the durability of the labor market recovery.

Monetary Policy and Interest Rates: At its July meeting, the Federal Reserve opted to keep the federal funds rate unchanged at 4.25%–4.5%, though two governors dissented in favor of a rate cut. While the decision itself was unsurprising, the Fed’s accompanying statement downgraded its economic outlook, suggesting that policymakers are inching closer to cutting interest rates again. However, Fed Chair Jerome Powell struck a more hawkish tone in his press conference, emphasizing caution amid ongoing tariff uncertainty and pushing back against political pressure for immediate cuts. This tempered market expectations for a September rate move—at least until the weak jobs report reignited speculation. As we progress into August, investors are weighing the resilience of the economy against a more complicated policy backdrop.

Market Recap

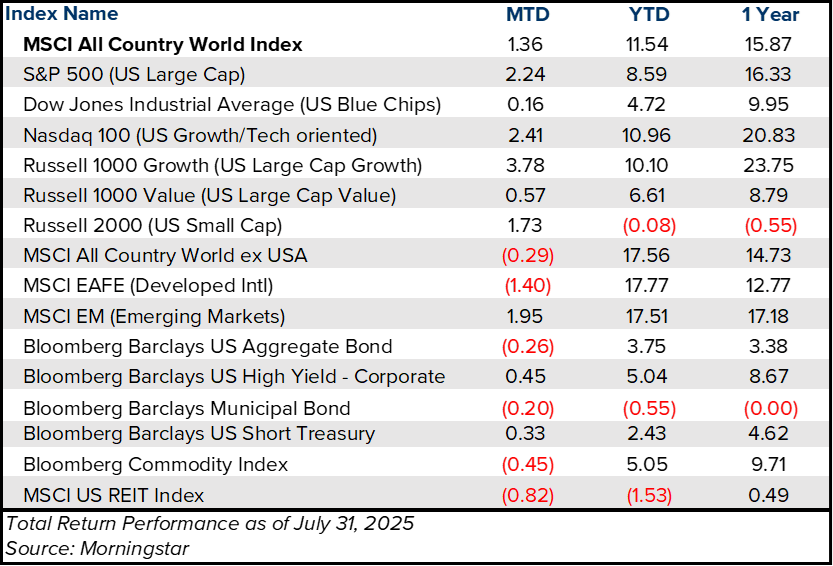

Equities: Equity markets continued their upward trajectory in July. The S&P 500 gained 2.2%, bringing its year-to-date return to 8.6%, buoyed by a six-day streak of record highs late in the month. Mid Cap stocks posted modest gains for the month, outpacing Small Caps but trailing their Large Cap counterparts, reflecting continued investor preference for scale and quality amid persistent macroeconomic uncertainty. Small Cap stocks, which are more sensitive to interest rates and trade policy, also rallied but remain in negative territory for the year.

Sector performance was led by Information Technology, which posted strong gains in July and is now up 13.7% year-to-date (YTD). However, Industrials remain the top-performing sector overall, with a 16.1% YTD return. Defensive sectors, such as Utilities, have lagged, weighted down by elevated interest rates and reduced demand for income-oriented equity exposure. International equities saw more mixed results. Developed markets, as measured by the MSCI EAFE Index, declined 1.4% in July but remain up 17.8% for the year. Emerging markets rose nearly 2% in July and are up 17.5% YTD, supported by improving trade dynamics and a weaker dollar earlier in the year.

Fixed Income: The broad bond market slipped 0.26% in July, only its second negative month of the year. Treasury yields rose, particularly on the short end, with the two-year yield climbing over 20 basis points to 3.95%. However, following the soft jobs report on August 1, yields retreated, and market odds of a September rate cut increased. Further out on the curve, longer-term yields remained relatively range-bound, reflecting a balance between moderating inflation expectations and ongoing uncertainty around the economic growth trajectory.

The U.S. dollar staged a sharp rebound in July, rising 2.7%—its best monthly performance since January. A combination of resilient economic data, a hawkish Fed stance, and favorable trade developments helped lift the greenback, particularly against the Euro, which weakened following a trade deal seen as more favorable to the U.S.

Wealth Enhancement Perspective

After a strong run, markets were reminded on August 1 that valuations remain sensitive to both policy shifts and economic surprises. While the longer-term outlook remains constructive, a period of consolidation may be warranted as investors digest a more nuanced growth and policy environment.

The economy has been resilient, but there are pockets of softness that may weigh on growth in the coming months and the severity of a potential slowdown remains uncertain. The full impact of new tariffs, the potential productivity gains from AI, and the fiscal implications of the new budget bill will take time to unfold. Encouragingly, leverage in the system is not heavily burdensome for most consumers or corporations, reducing the risk of systemic stress.

For long-term investors, this environment presents opportunities. Market dislocations can be used to harvest tax losses, rebalance portfolios, and deploy idle cash at more attractive valuations. Diversification remains key—allowing investors to capture opportunities across multiple asset classes and improve risk-adjusted returns against an uncertain economic backdrop.

This information is not intended as a recommendation. The opinions are subject to change at any time and no forecasts can be guaranteed. Investment decisions should always be made based on an investor's specific circumstances.

There is no guarantee that asset allocation or diversification will enhance overall returns, outperform a non-diversified portfolio, nor ensure a profit or protect against a loss. Investing involves risk, including possible loss of principal.

2025-8745