We all want our freedom. Many people in their working years are focused on financial freedom: the freedom to buy the things you desire, the freedom to experience what you want, the freedom to travel wherever and whenever you wish, the freedom to pay for your child’s education, or the freedom to purchase a vacation home. Sounds nice, right?

Time & Financial Freedom: Your Path to A New Life

The assumption is that freedom and money rise and fall together. More money means greater freedom, while less money means less freedom.

The challenge with this paradigm is that it frames freedom one-dimensionally. The truth is that freedom has two factors: time and money. It’s not only about our freedom to spend our money how we choose, but also about our freedom to spend our time as we see fit.

What Is Financial Freedom?

Financial freedom includes both the freedom of money, and the freedom of time. The challenge is striking a balance between the two.

Some people have an abundance of both kinds of freedom. They have all the money they need to purchase what they want, and they wake up each day with the freedom to do what they want. Sometimes, these folks have this freedom because they are retired. Others may still be working, but their work is so closely tied to their purpose that it is what they want to do. They may have daily obligations, but those obligations are exactly what they want to be doing.

Many others are not so fortunate. They might have high-paying jobs that allow them to live a desirable lifestyle outside of work, with a beautiful house, great vacations, retirement savings, and more. However, the challenge is that they no longer find their work fulfilling. They might trudge off to work, dreading the rest of the day, looking forward to the time they can quit and really start to enjoy life.

For others, the situation is much worse. Their jobs require them to work very long hours (think 10 to 12 per day), plus another hour or two in the evening catching up on emails. They keep this pace daily, and sometimes on the weekends too. They don’t sleep much, they don’t exercise, and they almost never take personal time to think about what matters to them.

How to Start on a Path to Achieve Financial Freedom

The path towards financial freedom starts with the acknowledgement of who you are, what your current situation is, and what you want to change.

Do you fit into one of the lower categories we described above? Has your job lost its sense of purpose? Are you working so hard you don’t have time to care for yourself?

After asking yourself these questions, it’s critical to be honest with yourself about the answers. Only then can you start to build your life back towards something enjoyable. If you deny that anything’s wrong, nothing will ever change.

To streamline the process for you, we’ve created a quick personal assessment to help you take inventory of your financial freedom, from the perspectives of money and time.

Personal Freedom Assessment

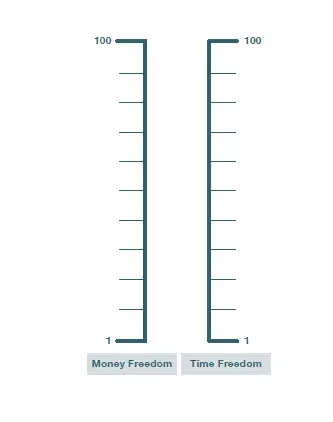

The best part of this assessment is that you can do it yourself, with a single sheet of paper (or a single note on your phone). First, draw two vertical lines. Label the first line money freedom, and the second line time freedom. Create a scale for each line from 1 to 100. Assume that the bottom of the scale represents virtually no freedom, and the top represents total freedom.

Then, ask yourself: On a gut level, where do you feel you are on each scale?

After that, ask yourself: How satisfied are you with your freedom on each scale?

If you can legitimately answer that you’re totally satisfied with your time and money freedom, be grateful, because many would consider you to be financially free.

If you’re not totally satisfied, where does your dissatisfaction lie? Do you have a shortage money freedom or time freedom? Often, but not always, our two freedoms have an inverse relationship. We can give up money in exchange for more time, or we can give up time in exchange for more money. If this is the case for you, are you willing to make that trade?

Moving Up the Scale

If you aren’t happy with where you are on either scale, there’s no time like the present to make some changes. You don’t have to make drastic lifestyle transformations to work towards improved results. In fact, by making smart, small changes, you can move upwards on both scales over time.

- Sometimes, our problems start in the simplest place: the budget. By using the ABC budgeting worksheet, you can automate your budgeting cashflows and make better money decisions. This can free up time, and potentially save you money by avoiding fees.

- Time-based problems are harder to solve, because there are only so many hours in the day. However, by using an approach called Behavioral Wealth Management, you can take control of your calendar and solve certain time-based problems at their roots.

Is Achieving Financial Freedom Worth It to You?

If you are willing to trade between your money and your time, the next obvious question is, how? Striking the ideal balance between the two is easier said than done. Once you start giving up more time for more money, it can be easy to slip into a reinforcing cycle that pressures you into giving up even more time. On the flip side, giving up money for time can be risky for your long-term financial health.

To analyze your options, you need to understand the financial costs and benefits of your choices. You’ll need to answer questions such as, “How will my proposed trade impact my ability to retire comfortably?” or “How will my trade help to take care of my ailing parents?”

Financial decisions impact very intimate parts of our lives. These questions aren’t easy to navigate on your own. The good news is that you don’t have to. Our Roundtable™ team of specialists can help.

Through goal-based comprehensive financial planning, we walk clients through the evaluation of goals for financial freedom and devise plans to help them move towards those goals. Whether or not you’re happy with your results of the Personal Freedom Assessment, you can present them to a financial advisor and receive a response crafted to your unique situation.

If you’re interested, reach out today for a complimentary no-obligation meeting with an advisor.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.