In 2025, an EV can be cheaper to own than a similar gas car if you drive more than 10–12k miles per year, can charge at home, and qualify for remaining tax credits before September 30, 2025. Otherwise, a hybrid/PHEV may offer better economics.

TL;DR: Should You Go EV in 2025?

- The federal clean vehicle tax credit can save you up to $7,500 on your EV purchase, but it expires at the end of September 2025.

- EVs are more expensive upfront, but generally have greater long-term cost savings compared to gasoline-powered vehicles.

- When deciding whether an EV is the right choice, consider your driving habits and how charging requirements will fit into your lifestyle.

How the EV Tax Credit Works in 2025

The federal clean vehicle tax credit has provided a key incentive for buyers to choose electric vehicles (EVs) over traditional gas vehicles. When you buy an electric vehicle, you can get a tax credit of up to $7,500.

The base credit amount is $3,750 for vehicles that meet either only the critical minerals requirement or only the battery components requirement. If your vehicle meets both requirements, you may qualify for the full credit.

It’s important to note that this tax credit is set to end after September 30, 2025. The 2025 federal budget bill, known as the One Big Beautiful Bill Act, repealed the tax credit ahead of its original 2032 expiration date.

Who qualifies: income, MSRP caps, and assembly rules

This tax credit is available to both individuals and businesses. To qualify for the tax credit, you must meet these key requirements:

- Income: You (or your business) must have an AGI of no more than $300,000 for married couples filing jointly, $225,000 for heads of household, and $150,000 for all other filers.

- MSRP: Your vehicle can have a manufacturer’s suggested retail price (MSRP) of no more than $80,000 for vans, sport utility vehicles, and pickup trucks, and $55,000 for other vehicles.

- Vehicle: Your vehicle must meet the following requirements for you to qualify for the tax credit:

- It has a battery capacity of at least 7 kilowatt hours

- It has a gross weight rating of less than 14,000 pounds

- It was made by a qualified manufacturer

- Its final assembly was in the United States

- It meets critical mineral and battery component requirements

Time-of-sale requirement

Starting in January 2024, your clean vehicle tax credit must be initiated and approved at the time of vehicle sale. The dealer must submit a time-of-sale report to the IRS that includes the buyer and vehicle information. The dealer should also provide a copy to the buyer. When buying an electric vehicle, review your time-of-sale report to ensure your tax credit was approved.

Used EV & commercial credits

As long as you purchase your vehicle on or before September 30, 2025, you’re eligible for a clean vehicle credit even if you buy a used car. The used clean vehicle tax credit is equal to 30% of the sale price, for a maximum credit of $4,000.

In other words, you would receive the maximum tax credit for any vehicle priced $13,333.33 or higher.

EV vs. Gas vs. Hybrid: The Cost Reality

When buyers are considering buying EVs, cost savings is one of the key reasons why. EVs generally have a higher upfront price tag, but then can provide cost savings over time. PHEVs (plug-in hybrids), on the other hand, fall somewhere in the middle.

Total Cost of Ownership (7-year view)

When you look at a seven-year ownership period, EVs provide cost savings for almost all vehicle types, according to Atlas Public Policy.

Their data shows savings of just over $2,000 for compact sedans. Meanwhile, compact SUVs saw the greatest savings, with a cost difference of more than $9,000 in favor of EVs. The pickup truck is the only vehicle type where a gas vehicle was actually more affordable over a seven-year period than its EV counterpart.

Factors included in their calculation are:

- Net price (purchase price minus resale value, tax credits, and incentives)

- Taxes and fees

- Insurance

- Fuel

- Maintenance and repairs

Fuel/energy cost math made simple

The data from Atlas Public Policy can be a helpful starting point, but it may not apply to your vehicle or usage. If you want a more personalized breakdown, the U.S. Department of Energy’s (DOE’s) Office of Energy Efficiency and Renewable Energy offers a vehicle cost calculator to help you see the cost breakdown based on your driving habits and various vehicle types.

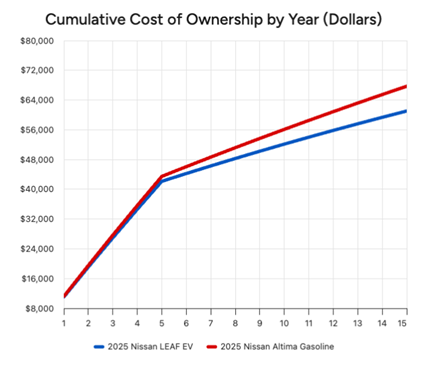

For example, if you enter a 2025 Nissan Leaf and a 2025 Nissan Altima (an EV versus a gasoline vehicle), you’ll find that the costs are comparable for the first five years, but then the Leaf provides several thousand dollars in cost savings after that.

Maintenance & warranties

According to Atlas Public Policy’s data, EVs have considerably lower maintenance costs than their gas-powered counterparts, to the tune of about 39% in the first seven years. However, you can expect your maintenance costs to increase after the first five years for both types of vehicles.

EVs also generally have longer warranties. A typical warranty on a gas-powered vehicle is three years or 36,000 miles, while EVs often have warranties as long as eight years or 100,000 miles.

It’s important to note that in March 2024, the Environmental Protection Agency (EPA) announced new emissions standards for light-duty and medium-duty vehicles set to take effect in 2027. In addition to reducing vehicle emissions, the EPA also foresees these changes to lower vehicle maintenance costs.

EV vs. PHEV vs. Gas Comparison

| Factor | EV (Battery Electric) | Plug‑in Hybrid (PHEV) | Gasoline Vehicle |

|---|---|---|---|

| Upfront Price (2025) | $35k–$60k (before credit); up to $7,500 credit IRS | $30k–$50k; some models get partial credit FuelEconomy.gov | $25k–$45k; no credit |

| Fuel/Energy Cost (per 1,000 miles) | ~$35–$45 (DOE Calculator) | ~$45–$65 | ~$120–$150 |

| Maintenance | Lower (fewer parts, no oil changes) | Moderate (engine + battery) | Higher (oil, transmission, exhaust) |

| Range per Fill/Charge | 200–350 miles typical | 25–50 mi electric + 300–500 mi gas | 350–500 miles |

| Refuel/Recharge Time | 8–10 hrs (home L2); 30–40 min DC fast | Gas refill in 5 min; overnight charge for electric | 5 min gas |

| Resale Value (2025 outlook) | Improving; varies by model, tied to battery health | Stable; niche | Stable, predictable |

| Federal Credit Eligibility | Yes, through Sept 30, 2025 (restrictions apply) | Yes, some models | No |

| Best Fit For | Daily drivers with home charging | Mixed driving, limited charging | Long‑haul drivers, no charging access |

Charging & Range: Will It Fit Your Life?

Neither EVs nor gasoline-powered vehicles can run forever. With a gas-powered vehicle, you’ll have to stop to fill your gas tank. And with an EV, you’ll need to stop to charge your battery.

EVs can often run for a few hundred miles without a charge, meaning you almost certainly won’t have to charge them every single day, unless you’re driving long distances. In fact, it’s recommended that you don’t charge your EV to 100% every day, as it can degrade your battery over time.

According to the U.S. Department of Transportation, EV charging can take anywhere from four to ten hours from empty with a Level 2 charger and between 40 and 50 hours (or more) for a Level 1 charger.

Because of the time commitment required to charge your EV, it’s important to consider how this will fit into your lifestyle.

Home charging basics

When you buy an EV, you can install an AC Level 1 or AC Level 2 charger at your home, either in your garage or outside. A Level 1 charger is by far the most affordable – there’s no additional cost of installation required. Level 2 equipment can charge your vehicle far more quickly, but have more expensive upfront costs. Installing Level 2 equipment may require consulting an electrician.

According to the DOE, Level 1 equipment with daily overnight charging is sufficient for most EV owners. You may only need to consider Level 2 equipment if you have an irregular driving schedule, a long commute, or an EV with a large battery.

Public charging today

Public EV charging stations are readily available today throughout the United States. Public charging is less convenient than at-home charging, since it may require you to sit at a different location for hours to charge your vehicle. But it can be convenient if you’re on a road trip or are already stopping at a location that offers charging.

The DOE has an Alternative Fueling Station Locator on its website to help you find fueling and charging stations for alternative vehicles, including EVs. There are also plenty of mobile apps that provide a similar service and may be more convenient to use on the go.

Plug standards converging (NACS / SAE J3400)

There are three types of EV chargers on the market in the United States: SAE CCS1, CHAdeMO, and J3400 (NACS). Starting in 2025, the North American Charging System (NACS) J3400 connector will be standard on electric vehicles within the United States. This technology was developed by Tesla, but is now being adopted by other EV manufacturers, including Ford and General Motors.

When a Hybrid or PHEV May Be Smarter

If you’re not ready to commit to an EV, a hybrid or plug-in hybrid could be a good option.

Hybrid vehicles are powered by both internal combustion engines and electric motors. The vehicle is essentially self-charging, thanks to its regenerative braking and internal combustion engine. As a result, you don’t have to worry about stopping at charging stations (but you will have to fill the gas tank).

The benefits of hybrid vehicles is that you’ll spend less on gasoline and can reduce your emissions and environmental impact.

A PHEV (short for plug-in hybrid) is another option. Like hybrid vehicles, PHEV batteries can charge through regenerative braking or the internal combustion engine. Alternatively, the battery can be charged. And if you charge your battery often enough, you can run entirely on electricity and avoid gassing up your vehicle altogether.

Consider a hybrid or PHEV if you’ll have limited charging access or make frequent long drives. PHEVs in particular may be a good option for someone who wants ultimate flexibility. They offer the option to run on gasoline and operate similarly to a standard hybrid or to run entirely off your battery like a true EV.

State & Utility Incentives

The federal government’s clean vehicle tax credit is going away at the end of September 2025, but you can still get a tax credit if you install an EV charging station at your home. Your credit is equal to 30% of the cost of the charging station, with a maximum credit amount of $1,000. This tax credit expires June 30, 2026.

In addition to the federal tax credits, there may also be state incentives for EVs and EV charging equipment. Some state governments offer tax credits like the federal government’s for the purchase of EVs and EV charging equipment. Meanwhile, some utility companies offer rebates for customers who install EV charging stations at their homes.

Safety & Environmental Considerations

If you’re considering an EV, it’s important to weigh the safety and environmental factors.

Compare emissions with EPA tool

Many drivers are turning to EVs as a way to reduce their carbon footprints. According to the EPA, EVs don’t emit any tailpipe emissions. PHEVs, on the other hand, only emit tailpipe emissions when they’re operating on gasoline only. While there is still an environmental impact from the production and distribution of electricity, they may still be more environmentally friendly.

If you want to know the estimated emissions of your vehicle, use the DOE’s Beyond Tailpipe Emissions Calculator.

Crash test ratings

Even if you’re prioritizing a vehicle based on its environmental impact, safety should still be a top consideration. The National Highway Traffic Safety Administration (NHTSA) shares safety ratings of vehicles on the market.

When you look up a vehicle on the NHTSA website, you can see its overall safety rating, the number of recalls, investigations, and complaints, its available safety technology, and how it ranks for different types of collisions.

Planner’s Checklist

Are you ready to decide if an EV is right for you? Here’s a quick checklist that covers everything we talked about above and can help you decide the right type of vehicle you need:

- Run the numbers: Use the DOE’s Vehicle Cost Calculator to compare multiple vehicles, including an EV, a PHEV, and/or a gasoline vehicle.

- Confirm IRS eligibility: Review the requirements for the IRS clean vehicle tax credit and Alternative Fuel Vehicle Refueling Property credit to see if you qualify.

- Estimate your home charging costs: If you’re okay with Level 1 charging, you don’t have to worry about an added upfront cost. But if you’d prefer the faster charging that comes with Level 2 charging stations, be prepared for a larger investment.

- Talk to an advisor: A financial advisor familiar with your situation can help you run the numbers and decide if an EV is the right choice for you. Talk to an advisor today to learn more.

FAQs

Is it cheaper to own an EV than a gas car?

While EVs has a higher upfront cost, it’s generally cheaper to own an EV over the long term. However, this calculation includes the current clean vehicle tax credit, which expires in September 2025.

When does the EV tax credit end?

The federal EV tax credit ends September 30, 2025. Vehicles purchased October 1 and after won’t be eligible for the tax credit.

Do leased EVs qualify for the tax credit?

No, leased EVs don’t qualify for the federal tax credit. However, the leasing company does qualify for the federal tax credit, and may pass those savings along to you as the lessee.

Can I still get the credit if my car is delivered after Sept 30, 2025?

According to the Department of Energy, you can claim the clean vehicle tax credit as long as you acquire your EV on or before September 30. A vehicle is considered to be acquired when there’s a written binding contract and a payment has been made, which can include a down payment or vehicle trade-in. As long as you’ve entered into your contract and made a down payment or trade-in by September 30, you’ll qualify for the credit even if you haven’t taken possession of the vehicle by that date.

How do I find chargers on a road trip?

You can often find EV charging stations at gas stations, grocery stores, hotels and other locations. There are apps designed to help you locate EV charging stations when you’re on the road. And on your road trip, consider staying at locations that specifically offer EV charging stations, including hotels or rental homes.

What are the warranties on new EVs?

Coverage varies from manufacturer to manufacturer but most offer warranties that last eight years or 100,000 miles.

What is the expected battery life of an EV battery?

EV Batteries can last anywhere from 10 to 20 years depending on a variety of factors.

How much are replacement EV batteries?

EV batteries vary in price, ranging from $5,000 to nearly $20,000.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

2025-9163

Disclosures & Sources

- Internal Revenue Service. “Credits for new clean vehicles purchased in 2023 or after.”

- Internal Revenue Service. “FAQs for modification of sections 25C, 25D, 25E, 30C, 30D, 45L, 45W, AND 179D under Public Law 119-21, 139 Stat. 72 (July 4, 2025), commonly known as the One, Big, Beautiful Bill Act (OBBB).”

- Internal Revenue Service. “Clean vehicle tax credits.”

- FuelEconomy.Gov. “Federal Tax Credits for New Plug-in Electric and Fuel Cell Electric Vehicles Acquired from January 1, 2023, through September 30, 2025.”

- Internal Revenue Service. “Important Information for Consumers Transferring Clean Vehicle Tax Credits.”

- Atlas Public Policy. “Comparing the Cost of Owning the Most Popular Vehicles in the United States: 2025 Update.”

- U.S. Department of Energy Alternative Fuels Data Center. “Vehicle Cost Calculator.”

- Kelley Blue Book. “Car Warranty Guide: Everything You Need to Know.”

- Kelley Blue Book. “Buying a Used Electric Car: 10 Things to Know Before You Buy.”

- Plug In America. “An Unsung EV Benefit: Longevity and the Battery Warranty.”

- U.S. Environmental Protection Agency. “Final Rule: Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles.”

- Federal Register. “Multi-Pollutant Emissions Standards for Model Years 2027 and Later Light-Duty and Medium-Duty Vehicles.”

- Ride & Drive Clean. “Should You Charge Your Electric Car Every Night?”

- U.S. Department of Transportation. “Charger Types and Speeds.”

- U.S. Department of Energy Alternative Fuels Data Center. “Charging Electric Vehicles at Home.”

- Joint Office of Energy and Transportation. “SAE J3400 Charging Connector.”

- U.S. Department of Energy Alternative Fuels Data Center. “Hybrid Electric Vehicles.”

- U.S. Department of Energy Alternative Fuels Data Center. “Plug-In Hybrid Electric Vehicles.”

- Internal Revenue Service. “Alternative Fuel Vehicle Refueling Property Credit.”

- U.S. Department of Energy Alternative Fuels Data Center. “Federal and State Laws and Incentives.”

- U.S. Environmental Protection Agency. “Greenhouse Gas Emissions from a Typical Passenger Vehicle.”