With the passing of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Congress reached a landmark agreement that provides over $2 trillion in economic stimulus to individuals and businesses via loan programs, tax incentives, credits and deductions.

Part of the CARES Act is a recovery rebate for all eligible individuals and households in the form of a new tax credit. Individuals filing income taxes can get up to $1,200, while couples filing jointly can get $2,400–plus an additional $500 for each child.

The announcement of the recovery rebate probably leaves you with some questions. Well, we have answers, so let’s dig in.

How do I know if I’m eligible for the rebate?

Single filers are eligible for the full $1,200 credit as long as your 2020 adjusted gross income (AGI) is below $75,000. For joint filers, your 2020 AGI must be below $150,000 to receive the full $2,400 credit. Only individuals and households are eligible for this rebate; businesses, trusts and estates are not.

Further, you can get an additional $500 per child. So, a couple filing jointly with two kids and a 2020 AGI of $145,000 will receive a $3,400 rebate. If that same couple has seven kids, they’ll receive a $5,900 rebate. There’s no cap on the number of children you can claim. However, if you are divorced and have children, only the parent who claims those children on their tax returns will receive the $500 credit.

There are also no age limitations. Whether you’re 28 or 88, it is one rebate per household, and everyone is eligible.

What if my 2020 AGI is over the threshold?

If your 2020 AGI is over the threshold ($75,000 for individuals, $150,000 for couples), then your eligible credit begins to phase out at a rate of 5% of your AGI over the threshold amounts. Essentially, for every $1,000 you make over the threshold, your credit is reduced by $50. Additionally, there is a second threshold that, if reached, your credit is phased out completely.

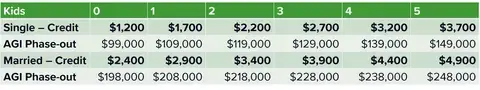

Figure 1 below shows the potential credits available and subsequent phase-out amounts for individuals and married couples with up to five kids. Our example married couple with two children are eligible for a full credit of $3,400, but that amount is reduced by $50 for every $1,000 over $150,000 they make–up to $218,000, at which point their AGI is too high, and they receive no credit.

Figure 1: Full Recovery Rebates and Phase-Out Thresholds

How is my 2020 AGI determined?

The credit amount is determined based on the AGI from your most recently filed tax return. That means, if you’ve already filed your 2019 taxes, then your rebate will be based on your 2019 AGI. However, if you haven’t yet filed 2019 taxes, then your recovery rebate will actually be based on your 2018 AGI.

Because of this, there are some scenarios where it makes sense to hold off on filing your taxes for 2019, particularly since the tax deadlines have been extended. If you made more money in 2019 than you did in 2018, that pay increase may have bumped your AGI over the threshold. In this case, it makes more sense to wait until you receive the tax recovery rebate to file your 2019 taxes, since the credit will be based on your 2018 AGI.

When, and how, will I receive my rebate?

This is technically a 2020 tax credit, but it’s actually being distributed in the form of an advance payment. The government is aiming for late-April to begin distributing these tax credits, but it could be early-May before you receive anything.

Rebates will be distributed directly into your bank accounts via direct deposit (if you previously used direct deposit for a tax refund) or by check to your last known address. If you moved since you last filed taxes, then a phone number will be provided that you can call to update your address.

If I receive a rebate based on my 2018 or 2019 AGI, but when I file my 2020 taxes, it turns out I’m not eligible, do I need to pay back the rebate?

Nope. This credit comes with no clapback, which means that once a rebate is paid, it’s yours–the government can’t ask for it back. After all, the government’s goal is to stimulate the economy. If people are worried about having to pay it back, they might not spend it–which would defeat the purpose.

Again, this is where it can come in handy to wait to file your 2019 taxes. Going back to our example family of four (married couple filing jointly with two kids), if their 2019 AGI is more than $218,000, they won’t receive the tax credit at all because it is over the phase-out threshold. However, if their 2018 AGI is less than $218,000, then it makes sense for them to wait to file their 2019 taxes until they receive the rebate. At that point, the credit is already distributed, and the government can’t ask for it back.

What if I’m retired and don’t pay income taxes because my only source of income is Social Security?

There are specific provisions in the bill where the government is going to look back to your 1099 Social Security statement for reference, and you will get issued a rebate. Again, everyone is eligible for this tax credit.

I still have more questions. What should I do?

As always, we encourage you to reach out to your financial advisor with any questions you may have and to learn more about the CARES Act and how the recovery rebate may affect your financial situation.