Bear markets are in the headlines again, as we recently saw the S&P 500 fall once more into bear territory. While we don’t believe this situation is markedly different than the one we found ourselves in a few weeks ago, we do believe it’s worth mentioning what makes this time a little different.

Friday, June 10 saw a higher-than-expected inflation report, indicating inflation may persist longer than originally anticipated. This had markets worried, because the Fed has already been tightening interest rates in response to elevated inflation, and fears of another rate hike sent markets spiraling.

The situation is challenging, to be sure. But with any challenge, opportunities exist. Read on to find out why we’re still optimistic about the long-term outlook.

Editor’s Note: The content below was previously published on May 23, 2022.

When you’re on a camping trip, the sudden appearance of a bear can understandably cause some anxiety and concerns – or even prompt you to re-evaluate your plans.

Similarly, a bear sighting in financial markets tends to be disruptive and prompt concerns among investors. This is what happened May 20, 2022, when the S&P 500 index crossed briefly into bear territory before ending the day just above that designation. Bear markets are typically defined as a decline of at least 20% from a recent high.

This event may seem like just the latest challenge in a year marked by volatility. High Inflation, geopolitical tensions, ongoing supply chain issues, and tighter monetary policy from the Federal Reserve have created what many consider an unfavorable macroeconomic backdrop this year. Now, the prospect of a bear market is concerning to many investors – and splashy financial media headlines are not helping.

But should this brief bear market sighting really cause a scare? It’s true that 2022 has had one of the worst starts in the history of US equity markets. Let’s take a closer look at the three types of bear markets, market upsides, and why this bear may not be as ferocious as some suspect.

Three Kinds of Bear Markets

There are three kinds of bear markets: cyclical, structural and event-driven according to Goldman Sachs. It’s worth exploring each one as they have different causes, and implications for potential financial events like recessions.

Cyclical Bear Markets

Cyclical bear markets are associated with the normal fluctuation of the business cycle. When the economy heats up, the fed raises rates to keep prices in line, resulting in a depressed outlook for economic growth and an associated sell-off. Cyclical bear markets have average declines of around 31% and last 21 months on average.

Structural Bear Markets

Structural bear markets are caused by reversing a major bubble or imbalance in the economy. The 2008 financial crisis was such a bear market. Individuals and business were over-extended on debt as banks began taking on more and more lending risk.

These types of bear markets tend to see deeper sell-offs, as they are correcting a fundamental flaw in the markets. On average, structural bear markets see declines of 57% and a 42-month recovery. The reason for the increased depth and time to recover is that even after consumers start to feel comfortable enough to spend more and businesses want to invest, banks are too impaired to lend, resulting in stagnation as the banks heal.

Event-Driven Bear Markets

Event-driven bear markets are caused by the market attempting to price in the impact of a specific event. The most recent example of this is the pandemic-driven declines in March 2020. The declines after the 9/11 attacks also fall into this category. Event-driven bear market sell-offs tend to be shallower, with an average decline of 29%, and the rebound tends to be much faster, averaging nine months.

Reasons For Optimism

Regardless of the type of bear market we might find ourselves in, all bear markets eventually come to an end and usher in the start of a new bull market, where economies grow and markets trend higher. Patience can be rewarded in the long-term, though the sentiment in the short-term can be unnerving.

In today’s information age, digital technology has enabled faster-moving markets, so information is absorbed and trades are executed much more quickly than a decade ago. This speed can make the current decline “feel” worse. Because the current decline has been felt over several months, patience can wear thin, especially when investors compare today’s market to 2020’s event-driven bear market. However:

A look at the S&P’s five biggest historical market declines and subsequent five-year returns below (See Figure 1) shows that post-bear market returns are historically attractive, and provide some cause for optimism:

Figure 1. Five Biggest Market Declines & 5-Year Returns

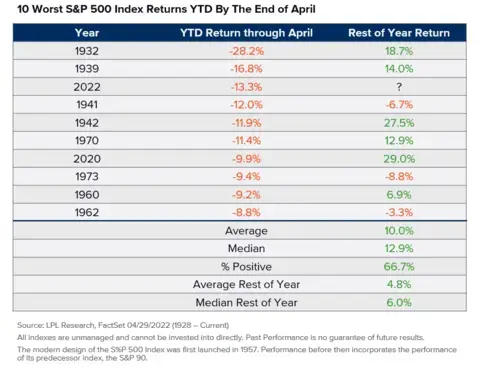

Although 2022 had the third-worst start to a calendar year in S&P 500 history (See figure 2), when looking back at other years with slow starts, the rest of the calendar year either had lesser declines or positive returns. On average, markets finished the year up 10%.

Figure 2. 10 Worst S&P 500 Index Returns YTD by the End of April

As we have seen, markets can shift quickly in both directions. The U.S. economy is a service-driven economy, which implies that it can be more agile than an industrial economy based on physical goods. Globally, the lifting of lockdowns in China may ease additional supply chain pressures, and the expected slowdown of profits for corporate America may be less severe than currently expected.

Bear With Us: Some More Context

A quick scan of today’s financial headlines may cause for concerns for some investors. But it’s also worth looking at other factors in play for a more balanced read on the markets and economy:

- The U.S. economy shows strong fundamentals: Unemployment has fallen to 3.6%, consumers hold roughly $163T of assets on their balance sheets, and debt payments as a percentage of disposable income has fallen to 9.2%; the lowest level since 1980.

- Corporations are healthy: S&P 500 corporations are flush with cash on their balance sheets, well above pre-pandemic levels. This leaves them well-positioned for dividends, buybacks, M&A, and capital expenditures going forward.

- Corporations are growing: Per FactSet, 77.3% of companies that have reported first-quarter earnings that have surprised to the upside. Earnings are up 9.2% and revenues are up 12.9% versus one year ago.

- Warren Buffet is buying again: After having bought nothing during the 2020 pandemic crash, the Oracle of Omaha is back to deploying cash and buying companies at value prices.

- Yields appear to be stabilizing at higher levels - Interest rates have risen sharply but have shown signs of stabilizing near current levels. This can help to reduce pressure on stock P/E ratios, which have accounted for most of this year’s market declines. This also has created the opportunity for bond investors to earn much higher yields than have been available in some time.

Finally, we shouldn’t lose sight of hidden opportunities in market volatility. As always, we will continue to closely monitor market conditions. If you have questions about how your specific financial situation may be impacted or want to explore potential opportunities for your plan, please reach out to your Financial Advisor.