For the period December 1 to December 31, 2023.

Executive Summary

2023 ended on a high note as the interest rate narrative shifted and consensus views broadly turned positive. The new year brings hope of an even more favorable environment for stocks and bonds, but recent history reminds us that consensus opinions can be unreliable.

What Piqued Our Interest

The three-month period ending October 27 was not so kind to investors as the market grappled with economic uncertainty, stretched market valuations, and future interest rate policy. During that stretch, the yield on the 10-year Treasury reached a 16-year high, briefly breaching 5%, while the S&P 500 declined 10% and fell into correction territory. Bonds were on track for an unprecedented third straight losing year, and concerns of an equity bubble surfaced again.

Schedule a meeting to find out how recent market performance may impact your financial plan.

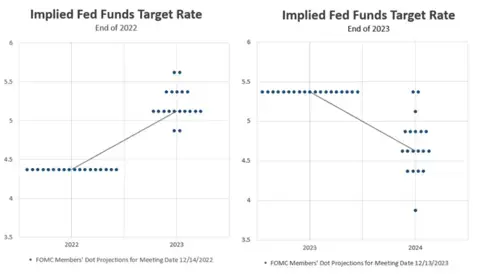

However, something happened in late October that picked up steam in November and continued into December. The rhetoric surrounding anticipated interest rate moves shifted towards easier monetary policy. While most market observers assumed that we were near the peak of the rate cycle, verbiage from the Fed left the possibility for additional hikes between the fourth quarter of 2023 and the first half of 2024. The Fed removed all doubt at their last Federal Open Market Committee (FOMC) meeting on December 13, adjusting their hawkish tone and even adjusting their “dot-plot,” implying three rate cuts may be coming in 2024.

Source: Federal Reserve

What changed that impacted the Fed’s outlook and perspective? The Federal Reserve has a dual mandate, which is to achieve maximum employment while keeping prices (AKA inflation) stable. Even as parts of the economy slowed this year, the labor market remained particularly resilient. The latest jobs report in November further demonstrated this as the unemployment rate ticked down to 3.7% while earnings growth held near 4% year-over-year. Despite multiple signals that the labor market may begin to deteriorate, such as an uptick in both continuing unemployment claims and temporary worker layoffs, overall job gains have held steady, supporting the “goldilocks” idea of a labor market that is cooler than it was but still warm enough to keep the economy going.

Meanwhile, the Fed may be well on its way to achieving its price stability mandate. In November, the Fed’s preferred measure of inflation, the Personal Consumption Expenditure Price Index, declined by 0.1% relative to the prior month. This was the first time the index declined month-over-month since April 2020 and brought the annual rate of inflation to 2.6%, inching ever closer to the Fed’s 2% target. Back in 2021, the Fed took a lot of grief for repeatedly referring to inflation as transitory, but as it turns out, they may have been accurate. The transitory period just took a little longer than they expected—and longer than most were willing to tolerate.

As the Fed’s rhetoric has clearly shifted, the big question heading into 2024 is whether a recession can be completely avoided, a far cry from the consensus opinion a year ago. The calls for a “soft landing,” by which inflation can be stemmed while avoiding an economic downturn, have risen substantially over the past few months. While we acknowledge the rising probability of such an outcome, we can’t rule out the possibility, given the lagged impact of higher rates and slower economic growth. For now, it does seem like we’ve turned a corner, as expectations for calendar year S&P 500 earnings sit at +11.6% year-over-year relative to an expected decline of -3.7% in 2023. If this turns out to be the case, then the “corporate earnings recession” is already in the rear-view mirror.

Market Recap

It was an impressive month for both stocks and bonds on the heels of the shift in expected monetary policy. The MSCI All Country World Index gained 4.8% and finished the year 22.2% higher, essentially eliminating last year’s losses. The S&P 500 capped off another spectacular year by gaining 4.54% for the month and 26.29% on the year, most of which can be attributed to the performance of Mega Cap stocks, frequently referred to as the “Magnificent 7.” The combined market cap of the Magnificent 7 reached approximately $12 trillion, which is equivalent to the value of Japan’s, Canada’s, and the U.K.’s stock markets combined. One of the more interesting takeaways in December was the massive outperformance of Small Caps, as evidenced by the Russell 2000. The Small Cap index surged 12.22% in December and finished at 16.93% for the year after massively lagging the rest of the U.S. market for most of 2023. Small Caps have higher borrowing costs and are more susceptible to higher rates; therefore, they are also more likely to benefit from anticipated rate cuts. Shifting our attention overseas, international stocks also finished strong but once again closed out the year trailing most U.S. indices. The MSCI EAFE Index, which tracks developed countries, gained 18.24% on the year, while the MSCI Emerging Markets Index gained 9.83%. The U.S. Dollar Index fell approximately 6.7% in the fourth quarter, which helped amplify international stock returns.

The Bloomberg U.S. Aggregate Bond Index had a monster December, at least in fixed income terms, gaining 3.83% to finish the year at 5.53%. Back-to-back months of declining yields helped the fixed income index avoid its third consecutive losing year, which would have been unprecedented in its 50-year existence. The yield on the 10-year Treasury, which peaked around 5% in October, continued to fall from 4.36% to 3.88% during the final month of the year. The spread of high-yield bonds over the 10-year Treasury dropped below 4% in December, helping drive performance for the Corporate High-Yield Index, which finished the year up 13.44%. Municipal bonds’ gross performance was a bit softer than taxable bonds for the month but still finished the year higher at 6.40%. The only sector that was in the red for the month (and for the year) was Commodities, which fell by 7.91% in 2023. The decline was primarily driven by the price of oil, as WTI Crude fell over 20% during the fourth quarter to around $71 per barrel.

Closing Thoughts

Perspective and humility are powerful attributes when assessing investment performance and determining the optimal path forward. Even those with extraordinary investment acumen are often wrong when it comes to market predictions, particularly in the short term, where market performance and economic reality often don’t align. At this time last year, we were experiencing the brunt of the fastest rate-hiking cycle on record while a recession appeared almost inevitable. But now, the market is approaching all-time records, and investor confidence is on the rise.

We are somewhat wary about the historically high concentration of Mega Cap stocks in the U.S., as well as the notion that lower rates may not impact earnings as much as some would hope. Prudent investors are mindful that what worked in 2023 is not guaranteed to produce the same results in 2024. No one can control or predict markets, macroeconomics, geopolitical events, or election outcomes. However, the optimal strategy is to create a structured plan to minimize risks, manage taxes, strategically rebalance, and bring a degree of certainty to whatever the new year brings.