When the topic of risk arises, many investors immediately think of market risk. The likelihood of a potential investment loss is a strong consideration in making financial decisions.

But other types of risk may be even more impactful to your overall financial well-being. These risks might not be marked by down-ticks in the stock market but natural disasters or personal injury.

Here are six considerations for incorporating risk management and insurance into a comprehensive wealth management plan.

1. Make Sure Your Coverage Keeps Up with Your Assets

Most people begin their careers without much financial capital. But over time, financial assets build up—a home, jewelry, antiques, art, cars, wine collection, etc.—and require additional protection against the risk of theft or natural disaster via property and casualty (P&C) insurance.

Not only is it important to have these policies in place, but you should also review them periodically to ensure that their promised benefits and coverages fit your current needs and objectives. After all, you want to make sure all your valuables are covered in case something unexpected happens.

On the flip side, it’s important to review your policies regularly, especially after you sell assets or downsize, so that you’re not paying for more insurance than you actually need. This kind of oversight can be just as risky to your overall financial health.

2. Protect Yourself and Family Against Sudden Income Loss

When things aren’t going so great for someone, we’ll often say, “At least he has his health.” That’s because our ability to work and earn a paycheck is arguably our greatest asset. But what happens if you have an accident or develop a medical condition? What happens if you lose your ability to work and earn your paycheck?

About one in 10 people with a disability were unemployed in 2021, about double the rate for those without a disability. Additionally, a 40-year-old has a 45% chance of becoming disabled for three months or more before age 65. This means that for those who are still working, it makes sense to have long-term disability insurance to protect your family against sudden loss of income due to an unexpected accident, illness or injury that may occur on or off the job.

Many people get disability coverage through their employer, but it may not be enough. Review how much coverage you can actually count on from your employer’s disability insurance, and if you feel underinsured, consider purchasing a policy on your own to supplement your current coverage.

3. Protect Your Family in Case of Premature Death of Earning Parent

Life insurance is a common way that people can protect their families from the catastrophic loss of a spouse or parent. There are two basic types of insurance:

- Term—Is often “rented” for a period of 10, 20 or 25 years

- Permanent—sometimes called whole life insurance, is owned and can be used to build supplemental savings or left to heirs

Term insurance can be used to replace a salary, pay off a mortgage, or pay for college if an earning parent dies prematurely. It has no residual cash buildup, is easy to cancel, and generally is the cheapest to purchase.

Frequently, employers offer term insurance policies through their benefits packages. Once you have sufficient assets to retire and/or your children launch into adulthood, there may be fewer reasons to buy or renew a term policy each year.

4. Include Permanent Life Insurance as Part of Your Estate Plan

If you’re looking to save more than you’re allowed in your workplace retirement plan or want to leave money to family members, permanent life insurance can act as a supplemental, tax-deferred savings account.

Unlike your 401(k) contributions, life insurance premiums are paid with after-tax dollars, and part of each payment will go toward paying for insurance coverage. The money invested in a permanent life insurance policy builds up cash value that can be withdrawn tax free. And because life insurance offers certain guarantees like never getting back less than your original investment, as well as tax-free death benefits to your heirs, it may help diversify a traditional investment portfolio.

Since policies follow strict rules on how and to whom they pay benefits, you should review your life insurance annually, especially when you’ve had a life change or there’s been a change in your income or the tax code.

5. Pre-Fund Long-Term Care

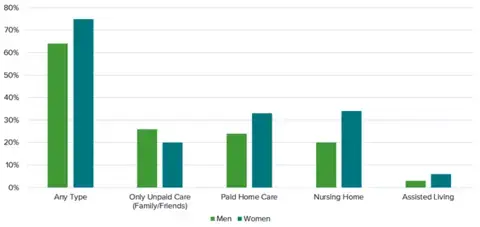

If you’re healthy now, it’s easy to fall into the trap of believing you’ll always be healthy. But the harsh reality is that it’s very likely you’ll need at least some form of long-term care (LTC) at some point in your life.

Figure 1. Lifetime Probability of Needing Assistance with Two or More Activities of Daily Living

Source: JP Morgan Guide to Retirement 2022

The costs associated with LTC are already high and continue to rise each year. And while you might hope or expect that your adult children or some other family member or friend can help provide care, the costs for these nonprofessional caregivers can be just as high.

You can lessen dependence on unpaid caregivers by purchasing an LTC insurance policy that will cover a certain amount of the daily cost of in-home professional care or care at a nursing home. Policies can be purchased with riders that allow couples or partners to share unused benefits, or with a hybrid structure that allows the policy to be used for both building cash value if LTC is not needed by the insured.

6. Mitigate Uncommon Sources of Risk

If you own a business or are in a business partnership, asset protection becomes a critical component of mitigating tax exposures and planning a smooth transition to future owners or partners. Depending on how your business is structured, as well as your individual financial circumstances and tax situation, there are a number of risk management and insurance strategies that may be available to your organization that can lower your taxable income, provide tax-advantaged growth, and provide tax-advantaged income to you in the future.

Incorporating Risk Management & Insurance in Wealth Management

You’ve worked tirelessly to build the life you and your family always dreamed of. Don’t let unexpected circumstances jeopardize everything and put your future—and your family—at risk.

Working in collaboration with a financial advisor and insurance professionals can help you anticipate threats to your financial well-being and plan for them accordingly. Reach out today to get the conversation started and find out how you can be better protected.